Will Rockland’s Closed Bank Branches Sit Vacant Or Morph Into Fast Food Restaurants, Etc.

By Rick Tannenbaum

Rockland County is littered with empty bank buildings — victims of an overzealous retail banking boom gone bust. Drive around the county and you’ll see a number of empty branches. So what opportunity does that represent for new uses, and for commercial agents selling the properties?

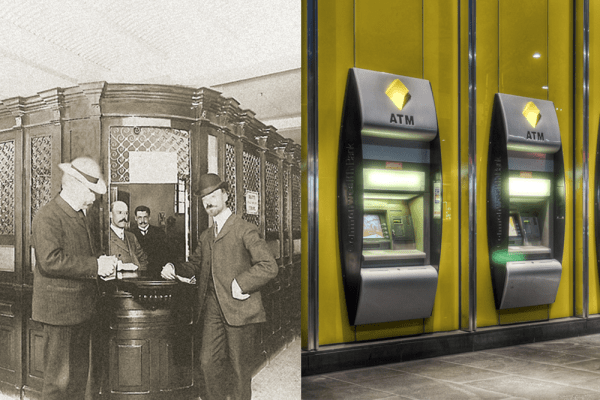

Many of the vacancies are due to rampant bank mergers that have made some branches obsolete. But the bulk of the empty buildings is a result of overbuilding, coupled with an unrealistic expectation of usage. The digital age has further changed banking habits, with almost every type of transaction possible from cell phone apps. Tellers push customers to use ATM machines for routine transactions, effectively accelerating their own redundancy.

Many of the vacancies are due to rampant bank mergers that have made some branches obsolete. But the bulk of the empty buildings is a result of overbuilding, coupled with an unrealistic expectation of usage. The digital age has further changed banking habits, with almost every type of transaction possible from cell phone apps. Tellers push customers to use ATM machines for routine transactions, effectively accelerating their own redundancy.

Banks however do tend to preserve the locations that serve corporate customers.

According to data provided by the FDIC, after years of net branch growth through 2009, with banks adding thousands of branches annually, there has been a steady net loss of bank branches from 2010 to date. Bank of America has closed more than 1500 branches since 2009. Chase Bank has reported its intent to close more than 400 branches. And Wells Fargo has been closing branches since its sales-practice scandal rocked the bank in 2016. It plans to or has already shed 450 retail branches. Citigroup has closed more than 30% of its branches since 2012.

How Will Retail Banks Be Reinvented?

So what to do with all of these closed bank buildings, many with large parking lots, some with existing drive-thrus, most on prime lots in retail corridors? Many are still owned by the banks themselves, others were sold long ago as NNN investments to investors who relied on the banks’ leases for a return, and now find themselves holding the empty building and competing with other empty bank branches for new tenants. And to compound matters, banks paid top dollar rents at their branches. Replacement tenants not so much, which results in a devaluation of the property, and reduced property taxes for the municipalities where the banks were located.

If national trends apply here in Rockland County, many branches will become fast food restaurants with drive-thrus, like Dunkin Donuts or Planet Wings. According to JLL research, buyers or tenants of vacated bank branches include restaurants, dry cleaners, law firms, medical practices, insurance brokerages, coffeehouses, art galleries and even other banks. Another investment option: Purchasing a bank branch and then razing the building to make way for a new ground-up development, as bank branches often under-utilize the capacity of the lots they sit on.

Other considerations for owner or investors include a review of the lease’s termination clause to see whether the bank is obligated to return the branch to “shell” condition. And, if the branch contains a vault, the investor should determine whose obligation it is to remove it – the cost of vault removal can range from $50,000 to $150,000.

A sampling of shuttered or about to be shuttered properties include:

- Key Bank on Middletown Road in Pearl River – 2000sf on a 1.5 acres lot.

- TD Bank, in West Ramapo Road in Garnerville, 3600sf on .9 acre lot.

- HSBC, 219 South Main Street in New City, 2400sf

- Chase Bank on Congers Road, 5,200sf on just shy of an acre.

- Chase Bank on Route 9W in West Haverstraw sitting 1.7 acres.

- Sterling Bank on Route 9W in Nyack, adjacent to Walgreens.

Rick Tannenbaum sells and leases commercial properties for Houlihan Lawrence Commercial Group. Reach him at rtannenbaum@hlcommercialgroup.com.

When Fair Leasing Terms Are a Workout (January 2, 2019)

Finding Balance in Scaffold Law Reform (December 11, 2018)

Economic Vitality Depends on Affordable Housing Options (November 26, 2018)

Opportunity Knocks on Haverstraw’s Door (November 4, 2018)

Real Estate Investors Rejoice Over New Depreciation Opportunities (October 23, 2018)