Capital Gains Changes Benefits Investors and Distressed Communities

By Rick Tannenbaum

President Trump’s new tax law allows real estate investors to take advantage of significant tax savings while investing in federally-approved designated distressed communities in need of economic growth. Specifically, the Village of Haverstraw has been named one of the New York’s 514 “Opportunity Zones,” the only one in Rockland County.

Unlike any prior tax incentive program, this law allows investors to defer and eventually eliminate capital gains on existing and future investments if those gains are re-invested in an opportunity zone through a qualified entity, such as a self-designated partnership, corporation or limited liability company.

Unlike any prior tax incentive program, this law allows investors to defer and eventually eliminate capital gains on existing and future investments if those gains are re-invested in an opportunity zone through a qualified entity, such as a self-designated partnership, corporation or limited liability company.

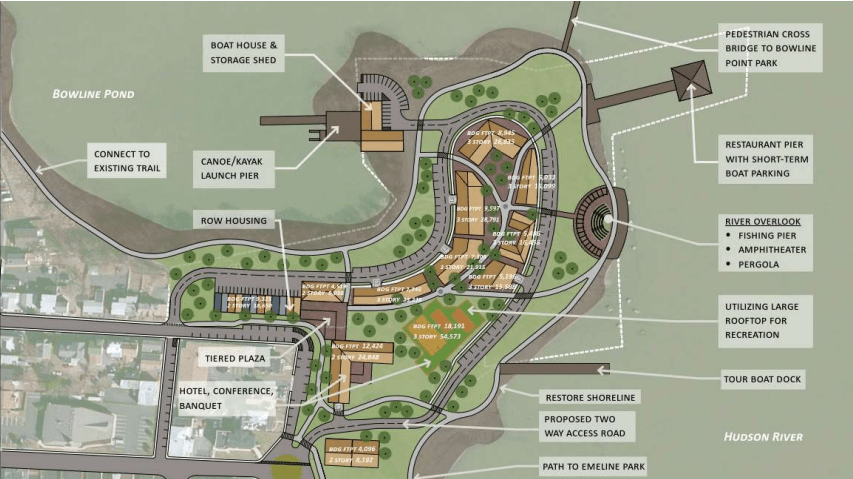

Nearly all of the Village of Haverstraw has been named an “Opportunity Zone,” which is based on census tracts and not municipal boundaries. However, nothing within the village represents a better opportunity than the nearly 10-acre, vacant waterfront parcel known as the Chair Factory, once the site of the Empire Chair State Factory. There are plans to build a mixed-use development on the Village-owned site.

The real benefit to Opportunity Zone villages, towns and cities is the requirement that the property invested in be substantially improved, generally meaning the owner invests as much money in the property as its original adjusted basis. For example, if an investor acquires a building for $800,000 — $500,000 attributable to land, and $300,000 to the building, the investor has to spend an additional $300,000, or a total of $1.1 million, to qualify for the tax benefits.

The idea of this program is to pump money into distressed towns, while benefiting investors who have substantial capital gains. An Opportunity Zone can receive funds from Opportunity Funds. Opportunity Funds provide investors the chance to put that money to work rebuilding low to moderate income communities. The fund model will enable a broad array of investors to pool their resources in Opportunity Zones, increasing the scale of investments going to underserved areas.

The idea of this program is to pump money into distressed towns.

A further incentive to investors is that gains made on that investment are excluded from gross income provided the investor holds the business or property for a decade. The new law allows the investor to step-up the basis in the property to reflect the then-fair market value when sold. So, when that building trades again ten years after its initial acquisition, there’s no gain to be realized.

Investors need not live in an opportunity zone to take advantage of these new benefits. Generally, both the deferral and exclusion of the capital gains from federal income flow through to New York State. This means those gains will also be deferred and excluded from New York taxable income.

Commercial buildings can be converted to residential use, factories can be re-invigorated, and adaptive reuses of marginal properties can be funded through tax savings available to investors seeking to shelter gains. Multi-family residential buildings also qualify for the program. The program is not limited to existing structures – an Opportunity Zone can contain parcels of fallow or under-developed land ripe for improvement.

City planners, as well as officials, commercial real estate brokers and investors should quickly try to absorb this new concept because it is both a boon to investors and a benefit to municipalities that are eager to take advantage of the opportunities to lure substantial investment to their communities.

Rick Tannenbaum runs a real estate advisory service for investors, and is a strategic planner and analyst. Reach him at rick.tannenbaum@live.com

Important Links:

Department of the Treasury Guidance on Opportunity Zones

Revenue Ruling 2018-29, Special Rules for Capital Gains Invested in Opportunity Zones

CDFI Viewer – Interactive Map Designated Opportunity Zones

Real Estate Investors Rejoice Over New Depreciation Opportunities (Earlier Column)