|

RCBJ-Audible (Listen For Free)

|

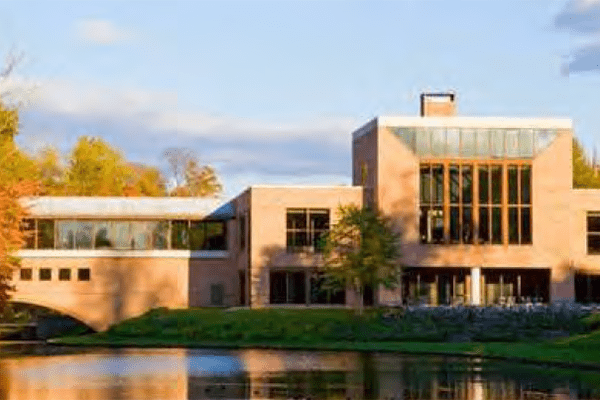

Town of Orangetown Expresses Confidence Over Sale of HNA Palisades

By Tina Traster

The team of California-based developers tapped one year ago by the Town of Orangetown to buy and transform the 106-acre HNA Palisades Training Center campus at 334 Route 9W in Palisades is seeking financing to purchase the property but it remains unclear as to whether the prospective developers need more than 100 percent financing, or whether they have investment partners.

REVEIL LLC, a Delaware Limited Liability Company, says in a capital request it’s in contract to purchase HNA for $33 million. The developers are seeking $26.5 million, which includes $5 million in acquisition, predevelopment, and financing costs to cover the purchase price for the hotel/conference facility owned by the Chinese entity. The capital request also represents that the team will provide $11.4 million in equity but it is ambiguous as to whether the team has an equity partner at present or is seeking one or more.

Between debt and equity, the team needs $38 million to acquire HNA, according to its capital request document, which RCBJ has obtained.

“It’s not clear how they are going to finance this project,” said a lender who requested anonymity.

The team is seeking an initial non-recourse loan of one year with extension options. Non-recourse means the principals are not personally liable if the loan defaults.

Mark Kitching and James Pelayo, the principals behind REVEIL, have hired IPA (Institutional Property Advisors,) a subsidiary of Marcus & Millichap, to seek funding for the project. In its three-page pitch for what it calls “The Palisades Center,” the applicants say they are “under contract” to buy the 206-room hotel and conference center built in 1986 and update the hotel with restaurants and a spa and convert the conference space into production studios. The pitch says the team “has received unsolicited interest from a major [production] agency.”

At least one lender who has viewed the pitch said it would be unusual for developers to seek 100 percent financing without any skin in the game, and to provide so little detail regarding their financials.

“It’s not clear how they are going to finance this project,” said a lender who requested anonymity.

It has been one year since REVEIL was tapped by the town to redevelop the site – a process that eliminated at least two local developers from the pool. Michael Zarin, outside counsel for Orangetown said, the two sides are “actively negotiating and are working diligently toward making a deal, but there is no signed contract yet.”

Zarin noted that the town had again extended the Memorandum of Understanding that guided the process between the town and REVEIL.

“We have extended the MOU to allow the parties to work toward consummating a deal,” said Zarin. “The town has been proactive but this is a private transaction. We are satisfied with the progress and feel confident about the transaction.”

The town inserted itself into the process of bringing a buyer to the table after a $40 million deal between HNA and a Brooklyn buyer fell through. The previous buyer left an $8 million down payment behind after unsuccessful litigation.

Now, observers are closely watching the evolution of the current deal, with some wondering how it will be funded. Beyond the $38 million, REVEIL says in its capital request that it’s planning a $50 million upgrade “to refresh the existing hotel and restaurant spaces and reprogram the conference facilities as production and content-creation spaces.”

The financial request does not indicate when the team will need the additional financing, or whether any of that financing will derive from subdividing and selling off part of the acreage.

More than a year ago during the contest to win the project, Kitching and Pelayo told the town the team included New Valley Realty, a real estate investment subsidiary of New Valley LLC, a wholly owned subsidiary of Vector Group Ltd (NYSE: VGR). Run by the heavyweight financier Howard M. Lorber, the team said, New Valley invests in renovations, conversions of office and rental properties to condominiums, underperforming assets, land development and sales, resort and urban hotels, core rental buildings.

It was later revealed that financier Lorber was never part of the team.

Officials have said the California-based developers have found new sources of funding for the ambitious project. However, the sources have not been revealed, and REVEIL has been seeking funds to cover both the sales price and pre-development costs.

A source privy to a telephone discussion between Lexington Henn, vice president of IPA, and a potential lender said the loan seekers rebuffed requests for financial information.

“They said ‘make us an offer,’” said the lender. “That’s not how it works.”

In the three-page pitch, there are no details regarding the team’s financial bearings, nor is there any detail regarding site plans or the property’s conditions. It is unclear as to whether IPA has sent additional information to prospective lenders.

Henn did not return an email seeking comment.

The clock is ticking on this project. The pandemic shuttered the hotel/conference center in 2020, and the property has been deteriorating. The IPA documents describe the HNA Center as a “pandemic resistant hospitality asset.”

The Kitching/Pelayo team has told the town it envisions an updated 206-room destination-branded hotel/conference center, restaurant and bar, world-class spa, event space, staff housing, a heliport, a community marketplace with retail, a five-acre working farm and farmers market, glamping, daycare, a 50,000 production and recording studio, offices, and a minimum of 100 coworking and other creative workshop spaces. Also, 20 to 30 townhomes, as well as catering and test kitchens. The property is not zoned for residential development.

Kitching is a real estate broker for Douglas Elliman and James Pelayo is a house builder. Kitching, director of the Douglas Elliman Estates Division, sells high-end houses in California and Pelayo, of Sunia Homes, is a small-scale developer of ultra-modern environmentally-efficient houses, also in California.

Pelayo is also listed as “architect” on Cornell Farms in the Town of LaGrange in Dutchess County, a redevelopment project that proposes 55 clustered single-family, environmentally-built houses and a farm-to-table restaurant, farm shops, a creamery, and brewery/cidery with 166 parking spaces.

For Cornell Farms, Pelayo had teamed with Tom Lee, a hedge fund manager, who purchased the 182 acres in 2019 for $2.4 million. The plan has been pending for 18 months before the Town of LaGrange planning board, The developers have received a negative declaration on their SEQRA application, but there has been little activity on that pending application.