|

RCBJ-Audible (Listen For Free)

|

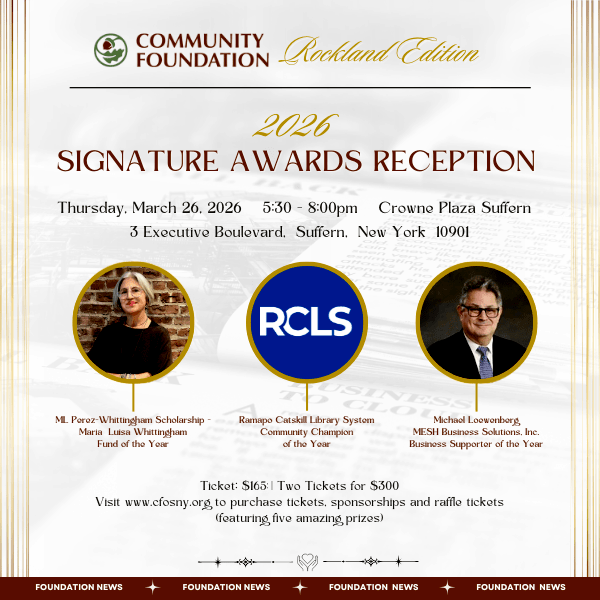

Lincoln Equities & L’Dor To Receive School, Town & County Tax Breaks; Plus Other Financial Incentives From Rockland County Industrial Development Agency

By Tina Traster

It took some doing for the developer to snag approvals to build a 220,000 square-foot warehouse off Route 303 in Valley Cottage, but eventually Lincoln Equities of Rutherford, New Jersey won its approvals. On Tuesday, at a special midday town board meeting with a packed agenda, the Town of Clarkstown made doing business with the town even sweeter.

The town passed two resolutions granting PILOT (payments in lieu of taxes) programs to Lincoln Equities and to the L’Dor adult care facility on West Clarkstown Road.

Both resolutions passed unanimously without discussion or questions from board members.

PILOT programs can be divisive subjects – loved by developers and often municipal leaders who want to attract commercial activity to communities. But they also raise concerns from taxpayers and others who believe deep-pocketed concerns benefit at the expense of local taxpayers.

Commercial activity generates jobs and eventually adds to the tax rolls, but PILOTs give developers breaks in the early stages of their projects. Many developers applying for PILOTs state on their applications that their projects would not be viable without tax reductions. They also say they’d need to relocate the project to another county or even out-of-state without the incentives.

For the 220,000 square-foot warehouse project on Executive Boulevard and Route 303 in Valley Cottage, Clarkstown has agreed to provide Lincoln Equities a level assessment of $7,141,200 over 15 years, and to phase in a discount schedule that would allow the developer to make payments in lieu of taxes based on 25 percent of the assessed value in the third year, with increments until the full tax burden was paid on the assessed value in the last two years.

The assessed value was set at just over $7 million dollars even though the developer said the new building would cost $29 million dollars to construct. There are no provisions to revise the assessed value, and no provisions to void the PILOT program if the developer flips the project to a large REIT or institutional investor.

For the newly constructed L’Dor adult care facility at 156 West Clarkstown Road, the town agreed to an assessed value of $1,663,575 for 15 years with payments in lieu of taxes starting at 18 percent of the assessed value and working up over 15 years to payments based on 100 percent of assessed value.

In its IDA application, the owner represented that the new building would cost $8.5 million to construct. Again, there are no provisions to modify the assessed value or void the agreement on the sale of the property.

Fixed assessments and reduced taxes enhance the value of the property as they reduce the costs associated with owning the property and increases the net income available to a potential purchaser. Buildings often sell based on a multiplier of net income.

The IDA has also granted the Valley Cottage warehouse developer extensive benefits in the form of exemptions for sales and use taxes and mortgage recording tax. Those non-PILOT benefits amount to an additional $2.9 million dollars.

For L’Dor, sales and use tax exemptions and mortgage recording tax exemptions total about $430,000.

Under the laws governing PILOT programs, the IDA provides the mechanism for the program, but the assessing authority, in this case the Town of Clarkstown, must formally approve the assessments and its participation in the program.

The County of Rockland IDA is the only IDA in New York State that is required by law to make payments in lieu of taxes, according to the New York State Department of Taxation & Finance. The agency must make payments to the appropriate municipality in either the full amount of municipal and school taxes, or for a lesser amount when specified in a written agreement with the municipality.

Many other IDAs voluntarily make payments in lieu of taxes, which vary in amount and duration by agency and location.