|

RCBJ-Audible (Listen For Free)

|

Residential Sales In Q3 2023 Decline By 25.3 Percent In Rockland; Similar Performance Throughout Hudson Valley

REAL ESTATE

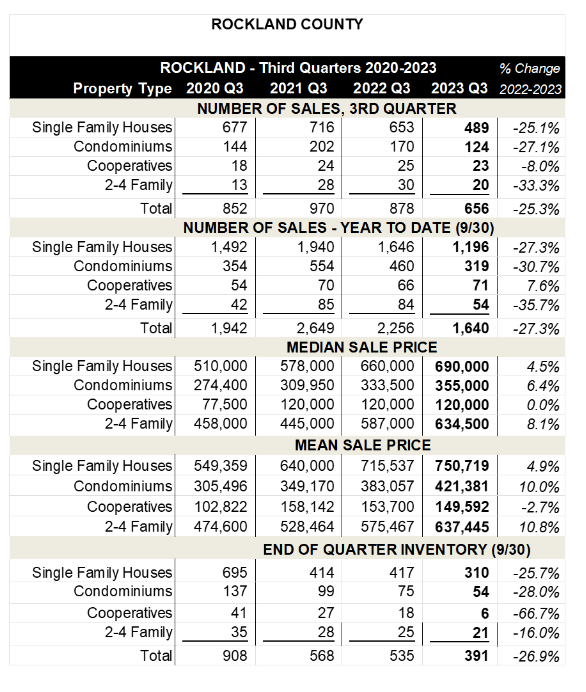

Higher interest rates continue to play havoc with the housing market, dampening buyer demand and keeping inventory low. Residential sales in 2023 third quarter declined by 25.3 percent in Rockland County though the median sale price in the county increased 4.5 percent to $690,000.

These factors explain the significant decline in 2023 third quarter sales transactions in Rockland, Westchester, Putnam, Orange, Sullivan and Bronx counties, according to Hudson Gateway Association of Realtors (HGAR).

In its 2023 Third Quarter Real Estate Sales Report, based on data provided by OneKey MLS, HGAR states that the median sale price of a single-family home increased modestly in every market area except the Bronx, which posted a small decline in sales price. Overall, for-sale residential inventory declined across the board, with Sullivan County reporting the smallest decline in inventory.

Realtors are banking on lower interest rates in 2024 to perk up the market, motivating homeowners to start selling again.

In the third quarter, overall residential sales compared to third quarter of 2022, fell 25.3 percent in Rockland County. Similar declines were seen throughout Hudson Valley: 20.8 percent in Westchester County; 33.8 percent in Putnam County; 22.6 percent in Orange County; 26 percent in Sullivan County and 23.7 percent in The Bronx.

Year-to-date through Sept. 30, 2023, sales have fallen sharply in all markets compared to the same time frame of 2022 – Rockland County sales declined 27.3 percent, while Westchester sales were down 25.9 percent; Putnam sales were down 28.8 percent; Orange County’s overall sales numbers declined 25.8 percent; Sullivan County sales fell by 28.1 percent and home sales declined 22.2 percent in the Bronx.

While home prices have stabilized in some sections of the United States, lack of inventory continues to put upward pressure on prices in the Hudson Valley, according to HGAR.

On a brighter note, the median sale price of a single-family home in the third quarter increased 4.5 percent in Rockland County to $690,000. Similar rises were seen regionally: 6.3 percent to $925,000 in Westchester County; 1 percent in Putnam County to $510,000; 7.1 percent in Orange County to $450,000; and 7.3 percent in Sullivan County to $299,500. The median sale price of a single-family home in the Bronx fell 2.8 percent in the third quarter to $612,500.

The prolonged high interest rate environment has deterred homeowners from selling.

The 30-year fixed mortgage rate was 7.67 percent for the week ended Oct. 6, according to the Mortgage Bankers Association—the highest level since 2000 and 40 basis points higher than a month ago. Inventory levels in every market took a turn for the worse, posting residential declines (year-to-date) of: 26.9 percent in Rockland. And 31.8 percent in Westchester; 26.9 percent in Putnam; 18.6 percent in Orange; 6.4 percent in Sullivan and 26.1 percent in The Bronx.

Area Realtors say the inert sales environment will continue until the Federal Reserve Board provides more clarity on its interest rate strategy.

National Association of Realtors Chief Economist Lawrence Yun, during his Oct. 10 visit to the HGAR offices in White Plains, noted the National Association of Realtors and the National Association of Home Builders recently sent a joint letter to the Federal Reserve requesting a pause in any further interest rate increases for a few months to see if the inflation rate will fall even further in reaction to past interest rate increases.

Yun predicts that come the spring of 2024, lending rates will be in the mid-6 percent region.

“Consumer prices are not fully compliant, though they have decelerated from last year,” said Yun. “In September, inflation rose at 3.7 percent, the same as in the prior month but slower than 8.2 percent a year ago. The Federal Reserve’s goal of raising the interest rates has been to bring inflation to near 2 percent.”

Yun also said rents rose 7.4 percent from a year ago.

“This is the main reason why consumer prices are not fully under control and why the Fed refuses to consider cutting interest rates,” he said. “It is nonetheless inevitable for rent growth to slow because of the construction of multiple new apartments. Inflation and interest rates will be lower next year.”