|

RCBJ-Audible (Listen For Free)

|

New York State Consolidated Funding Application Now Open; New Capital Grant Program Will Award Funds to Projects Located in Pro-Housing Certified Communities

Round XIV of the Regional Economic Development Council Initiative is open.

Round XIV includes $445 million in core capital grant and tax-credit funding combined with a wide range of programs from eight state agencies, including $100 million in grant funds from Empire State Development (ESD), available to projects on a continuous basis.

Councils are encouraged to support projects that advance or address strategic state priorities – including distressed communities, childcare, innovative public-partnerships, green buildings, and sustainable development.

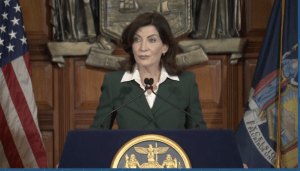

“The latest round of the Regional Economic Development Council Initiative will continue the transformational work we’re doing throughout New York State,” Governor Kathy Hochul said. “Our state investments will fund projects in Pro-Housing Certified Communities and beyond that will encourage public-private partnerships and make a difference in the daily lives of New Yorkers. I look forward to seeing plans that will support small manufacturers, broaden access to childcare, help build a sustainable future and pave the way to opportunity.”

“The latest round of the Regional Economic Development Council Initiative will continue the transformational work we’re doing throughout New York State,” Governor Kathy Hochul said. “Our state investments will fund projects in Pro-Housing Certified Communities and beyond that will encourage public-private partnerships and make a difference in the daily lives of New Yorkers. I look forward to seeing plans that will support small manufacturers, broaden access to childcare, help build a sustainable future and pave the way to opportunity.”

In Round XIV, ESD is launching two new grant programs: the Capital Improvement Grants for Pro-Housing Communities Program and the Small Manufacturer Modernization Grants Program. Up to $40 million will be available to municipalities, counties and not for profits through the Capital Improvement Grants for Pro-Housing Communities Program, to support capital improvement and placemaking projects located within Pro-Housing Communities that are certified by Homes & Community Renewal. The program is designed to directly support local participation in Hochul’s Pro-Housing Communities Program to invest in and create more vibrant communities throughout New York State. Grant awards will range from $100,000 to $3 million.

Up to $10 million will be available through the Small Manufacturer Modernization Grants Program, which will award grant funds to small legacy manufacturers across the state to invest in modernization and integration of advanced technologies. Grant awards will range from $50,000 to $250,000.

MUNICIPAL APPLICANT MUST BE A CERTIFIED PRO-HOUSING COMMUNITY

$100 million in ESD grant funds will be made available on a rolling basis, with awards made throughout the year. This year, municipal applicants must be a certified Pro-Housing Community. In Rockland County, only the Town of Ramapo, and the Villages of Nyack, Haverstraw and Kaser have submitted applications and letters of intent to become certified as Pro-Housing Communities.

Additionally, a second round of the Not-for-Profit Capital Grant Program will make up to $5 million available to award matching fund grants to not-for-profit organizations that provide economic and community benefits in their region to assist with facility improvements and upgrades. Grant awards will range from $25,000 to $100,000.

New York State Homes and Community Renewal Commissioner RuthAnne Visnauskas said, “There are more than 50 Pro-Housing Communities already certified, with at least 170 more in the pipeline. With the launch of ESD’s new $40 million Capital Improvement Grants for PHC program and $100 million more in funds targeted to Pro-Housing Communities, New York State is taking the lead in empowering communities to chart their own inclusive economic growth potential.”

Localities must achieve the “Pro-Housing Communities” certification to apply to key discretionary funding programs, including the Downtown Revitalization Initiative (DRI), the NY Forward program, the Regional Council Capital Fund, capital projects from the Market New York program, the New York Main Street program, the Long Island Investment Fund (LIIF), the Mid-Hudson Momentum Fund, and the Public Transportation Modernization Enhancement Program (MEP).

Regional Strategic Planning Process Update

The 10 REDCs are guided by their regional strategic economic development plans, which emphasize each region’s unique assets and provide strategies to harness local resources to stimulate regional economic development and create jobs Statewide. Each Regional Council will be tasked with creating an annual report that highlights the state of their respective region and how they are implementing last year’s updated strategic plans.

Consolidated Funding Application

The Regional Councils will score projects submitted through the Consolidated Funding Application (CFA), the State’s streamlined application for State resources which includes programs from numerous agencies. It is designed to give project applicants expedited and streamlined access to a combined pool of grant funds and tax credits from dozens of existing programs. This year, funding is available from eight State agencies across more than 20 programs. Regional Councils will review projects and provide scores that reflect how well a project aligns with a region’s goals and strategies.

CFA Workshops will be held throughout the State for applicants to learn about programs offered through REDC Round XIV along with additional funding opportunities from various state programs including offerings from the Office of Strategic Workforce Development and Small Business Programs by ESD. A full schedule of workshops can be found here.

The 2024 REDC Guidebook and a list of additional resources available to REDC Members are accessible here. The CFA application deadline is Wednesday, July 31st at 4 p.m. Open enrollment programs are not subject to the July 31st deadline and will continue to accept applications on an ongoing basis until funds are exhausted.

To date, through the REDC Initiative, more than $8 billion has been awarded to more than 9,900 job creation and community development projects consistent with each region’s strategic plan.

DataBank Holds Ground Breaking Ceremony For Construction of Orangeburg Data Center Campus

The recent groundbreaking for DataBank marks the latest IT infrastructure expansion in the rapidly growing New York market to meet the demand for increased capacity and mission-critical IT infrastructure and services.

“Our new Orangeburg campus lays the foundation for artificial intelligence infrastructure in New York State’s Hudson Valley,” said DataBank CEO Raul Martynek. “Its construction perfectly aligns with the State of New York’s Empire A.I. Initiative, which endeavors to establish New York as the national leader in A.I. research and innovation.”

DataBank’s first data center on the campus – LGA3 – is under construction and is expected to open in early 2025 with 200,000 square feet of data center capacity and 30MW of critical power (expandable to 45MW) delivered via an on-site sub-station. The site will eventually accommodate a second facility and another 45MW on-site substation.

DataBank’s first data center on the campus – LGA3 – is under construction and is expected to open in early 2025 with 200,000 square feet of data center capacity and 30MW of critical power (expandable to 45MW) delivered via an on-site sub-station. The site will eventually accommodate a second facility and another 45MW on-site substation.

The Orangeburg Campus also will be connected to DataBank’s major carrier hotel locations at 111 8th Avenue and 60 Hudson in Manhattan, as well as 165 Halsey Street in Newark, NJ (EWR1) providing “one-hop” performance for latency-sensitive financial, media and A.I. applications.

“The Town of Orangetown extends a warm welcome to the inaugural data center on the Orangeburg campus, as it represents a significant milestone in our region’s journey towards technological advancement and economic growth,” said Teresa Kenny, supervisor of the Town of Orangetown. “We look forward to a long partnership with DataBank which has already proven to be a responsible corporate citizen in many ways.”

The Data Center impacts economic development countywide.

“Today marks a pivotal moment for Rockland County as we celebrate the dedication of this cutting-edge data center campus,” said Lucy Redzeposki, Rockland County Director of Economic Development. “This investment not only brings new jobs and revenue to our community but also solidifies our position as a hub for technological excellence and economic prosperity.”

Rockland Film Financing Firm Censured by SEC

A Rockland County film financier has agreed to settle charges with the U.S. Securities and Exchange Commission for failing to disclose conflicts of interest to his investors.

The SEC censured Christopher Conover, 47, of Blauvelt, and his Hudson Valley Wealth Management Inc., of Pearl River, in a May 14 cease-and-desist order.

The settlement says Conover and his firm violated SEC rules forbidding investment advisers from engaging in any transaction “that operates as a fraud or deceit upon a client” and for making misleading statements to investors.

Conover was ordered to pay $777,711 and Hudson Valley Wealth Management was ordered to pay $200,000 to the SEC.

Conover founded HVWM in 2008 to provide wealth management services to wealthy investors. As of March, the firm reported that it was managing $112 million for 90 clients, according to Westfair.

In 2014, Conover set up a fund for making loans to film and TV production companies. In 2017, he negotiated a deal to raise money exclusively for Toronto producer Jason Cloth’s Creative Wealth Media Finance Corp. and Bron Studios.

In 2014, Conover set up a fund for making loans to film and TV production companies. In 2017, he negotiated a deal to raise money exclusively for Toronto producer Jason Cloth’s Creative Wealth Media Finance Corp. and Bron Studios.

Loans were typically for one to two years and carried interest rates from 10 percent to 30 percent. Conover’s investors made money when loans were repaid.

Conover raised about $22 million for eight films, according to the SEC. One of the projects, for instance, was “Bombshell,” a 2019 film featuring Charlize Theron and Nicole Kidman as employees who take on Fox News executive Roger Ailes and a toxic workplace.

Conover was paid $531,787 as an executive producer for the films, according to the cease-and-desist order, and none of that money was distributed to his clients.

In 2021, the production company began defaulting on the loans and Hudson frequently lacked sufficient cash to redeem client investments. When that happened, the SEC says, Conover would partially satisfy clients’ redemption requests on a pro rata basis.

But in May 2021 he deviated from that practice and gave one client preferential treatment. He paid the full amount requested, $187,789, to a portfolio manager of a large private equity firm whose help he wanted, according to the SEC. He paid nothing to other clients who were trying to redeem $750,000.