|

RCBJ-Audible (Listen For Free)

|

Clarkstown Councilman Calls For Redistribution Of County Sales Tax Dollars

BUSINESS REPORT

Clarkstown Councilman Don Franchino says it’s time to level the playing field – and if that means turning the town of Clarkstown into a city, then so be it.

The reason? Sales tax. The Councilman says the town is shortchanged by the county’s distribution of sales tax dollars, and converting to a city would allow Clarkstown to leverage its entitlement to additional sales tax.

“We are in the basement, as far as sales tax,” said Franchino, citing that all the towns and villages in the county share only about 6 percent of the what the county collects. “I have spoken to the County Executive, but he won’t budge.” Franchino has also raised the issue with Supervisor George Hoehmann but has had no traction.

“After this election is over, I will push the town council to hire a consulting firm to make Clarkstown a city, and to finish what Alex Gromack started. To hell with the county.”

Nearly 60 percent of the county’s sale tax is collected from the Palisades Center, the Shops at Nanuet and the miles of strip centers lining Route 59, according to Franchino. But the distribution of sales tax is not proportional to how it is collected.

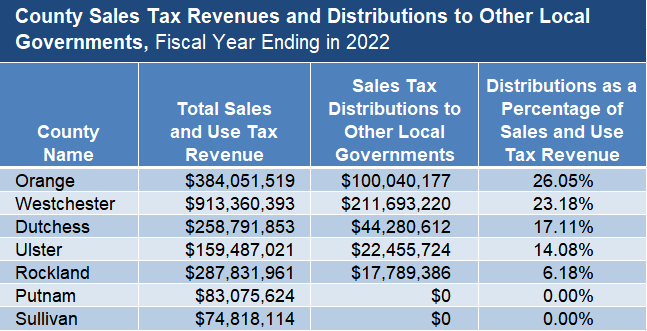

This issue is a bugaboo for Franchino, but one that bears discussion. An annual report issued by New York State Comptroller Thomas DiNapoli’s office sheds light on the allocations given to towns and villages in different counties in the Hudson Valley and around the state. For example, Westchester County allocates 23 percent of the sales taxes it collects to its municipalities, while Orange County allocates an even higher amount, 26 percent.

Sales tax allocations are made in accordance with sharing agreements between the counties and their cities, towns, and villages. Sales tax sharing agreements are required when county sales taxes are allocated on a basis other than population. All sales tax sharing agreements must also be approved by the State Comptroller.

Sales tax in Rockland County is 8.375 percent of taxable items like clothing, appliances and cars. Of that, 4 percent is the state’s share, and .375 percent goes to the MTA. The other 4 percent, collected by the county, is shared under a formula that many agree needs revision.

“The Town Supervisors have, in the past, discussed this issue with County Executive Ed Day,” said Orangetown Supervisor Teresa Kenny. “All of the Supervisors have recently discussed wanting to sit down with Mr. Day to discuss a change to the allocation. I am certainly open to having a discussion about it.”

In Rockland County, of the 4 percent sales tax collected, 3.75 percent is retained by the county. Another .125 percent gets shared among the towns and villages based on population. And the remaining .125 percent goes to towns and villages with police departments, based on the number of police officers.

To give that some context, according to the report, for fiscal year 2022, Rockland County collected more than $287 million dollars in sales and use taxes. Of that amount, just shy of $18 million was shared by the towns and villages. That amounts to about 6 percent of the total collected, or in other words, Rockland County kept 94 percent of all sales and use taxes collected in 2022.

How does that compare with neighboring counties?

In Orange County, where the county sales tax is only 3.75 percent, 2022 collections were about $384 million, largely due to the Woodbury Common outlet stores, and more than 26 percent, over $100 million were shared by the cities, towns, and villages in the county.

Westchester, which has a 4 percent county sales tax rate, the same as Rockland, collected more than $913 million in 2022, and shared $211 million, more than 23 percent of the amount collected.

Ulster, which collected $160 million in sales tax, shared $22 million, or about 14 percent.

On the flip side, Putnam and Sullivan, which collected $83 million and $74 million, respectively, keep the entire amount collected and do not share any sales or use taxes with its towns or villages. Suffolk County on Long Island does not share its sales tax revenue. Most counties, but not all, share a portion of their sales tax revenue with cities, towns, villages and/or school districts within their borders.

Historically, the concept of sales taxes originated at 1 percent in 1933 in response to the Great Depression and were supposed to sunset after one year. That didn’t happen. Rarely do we ever see a successful tax disappear, and in this case, sales tax has become an economic staple.

The New York State Comptroller’s office anticipates a 4% increase in sales tax revenues for 2024. Rockland County’s budget has an expectation of sales tax revenue of $285 million for 2024. Clarkstown’s 2024 budget is projecting its share of County sales tax revenue of $5.3 million.

All eligible counties and 18 cities, including New York City, impose a sales tax at rates ranging from 3 percent to 4.75 percent.