|

RCBJ-Audible (Listen For Free)

|

Building On Success, RCF Hopes To Bring More Businesses Under Its Tent

By Tina Traster

Seamless charitable giving isn’t just for large, corporate entities. Small to mid-sized businesses play a significant role in giving, even outperforming larger companies.

Small and medium sized companies donate 250 percent more to nonprofit and community causes than larger companies, and 75 percent of small-business owners donate an average of 6 percent annually, according to data compiled by SCORE, a volunteer business mentor network.

With that in mind, the Rockland Community Foundation has launched a Corporate Advised Fund program to capture local companies that want to professionalize their charitable giving efforts.

“We recognize that a lot of sizable businesses have their own foundations for charitable giving programs,” said Julie Sadowski, executive director of RCF. “But what about small and midsized businesses? Many do not have the bandwidth. They’re not necessarily able to internally manage this. The Corporate Advised Fund is RCF’s way of streamlining the process.”

RCF, founded 20 years ago, manages $6.5 million in assets for more than 120 funds. It partners with the Community Foundation of Orange & Sullivan.

The community foundation in two decades has doubled its assets under management and tripled the number of funds it stewards.

“We grant more than $500,000 a year,” said Sadowski.

A community foundation is a public charity that typically focuses on supporting a geographical area, primarily by facilitating and pooling donations into coordinated investment and grant making instruments used to address community needs and support local nonprofits. There are about 900 community foundations nationwide. Its long-term goal is to build permanent, named funds, for the broad-based public benefit of the residents.

Businesses are contacted for support and donations all the time.

The idea of the Corporate Advised Fund is that businesses set aside funds when times are good – and use them as a bulwark to continue charitable giving when economic times are more challenging. The funds are invested in a diversified portfolio.” The volatile stock market notwithstanding, Sadowski says RCF invests conservatively.

The Corporate Advised Fund will have a slightly different fee structure than the existing funds (see chart below) but it builds on the foundation’s notable work in the county.

Apart from the Corporate Advised Fund, RCF offers the following:

Donor Advised Funds are for donors who want to actively recommend grants to nonprofit organizations or for charitable projects such as The Anne & Pat Byrne Charitable trust, which supports “charitable organizations that respond to worthwhile human needs for the purpose of improving society.”

Field of Interest Funds target a specific area of interest, program or cause in the county. For example, The Arts Council of Rockland has established the Artist’s Support Fund for practicing artists in need of funds to support their work.

The Agency Funds for Non-Profits is a fund for 501(c)(3) nonprofit organizations that leave fund management to RCF, such as Cornell Cooperative Extension Fund of Rockland, which supports core programs in youth development, the environment, horticulture and gardening, nutrition, and nonprofit management.

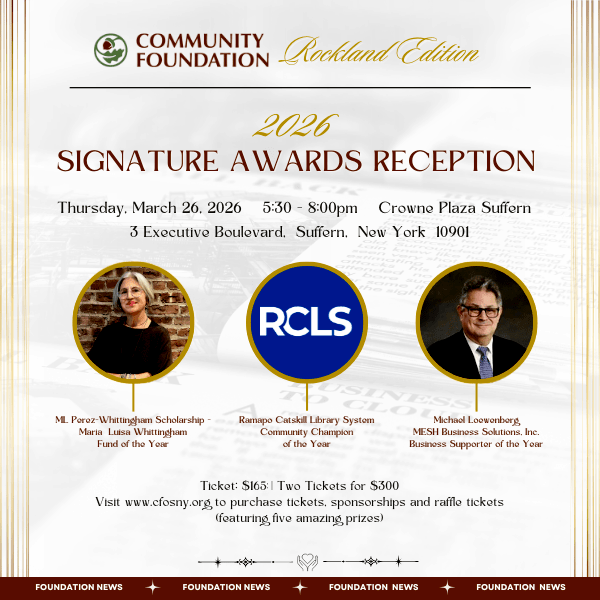

RCF offers Scholarship Funds for donors who want to establish a fund to benefit students at any education level.

The community foundation also stewards Project Funds for individuals or groups who want to avoid the time and expense of establishing a separate 501(c)(3) organization. These funds can also be set up by organizations that are in the process of filing for 501(c)(3) status but want to accept donations for their cause.

In 2021, mortgage broker/photographer George Pejoves came up with the Cornhole Benefit Challenge to raise money for a handful of his favorite charities including Center for Safety and Change and the Nyack Center. To bring the project to fruition, he established a project fund with RCF “because the logistics of collecting and dispersing the funds was a mystery to me,” said Pejoves. The successful event, which drew lawyers and real estate professionals, brought in $10,000 in donations and Pejoves planned to make this a bi-annual event.

Last month, he held the second Cornhole Benefit Challenge at Red Barn Cidery, which raised $16,000.

“The RCF fund is a good way to avoid the paperwork,” said Pejoves. “But it also adds legitimacy to the flow of money. When you’re raising money, you don’t want any perception of wrongdoing. There are a lot of scams out there.”

Like project funds, RCF also has funds for special events such as Golf Outings, Walk-a-Thons, Gala Dinners and others.

“The benefit of establishing an Event Fund is to accept donations, help manage acknowledgement letters, sponsorships, and other administrative tasks.”

Fee Schedule

- One time fee of $200 to open any fund

- Annual Administrative Fees:

$350/year (field of interest, project and scholarship funds (if fund balance is $25,000 or less (pulled automatically from fund $62.50 per quarter).

1.25% if fund balance is greater than $25,000 up to $1 million. 0.75% on funds over $1 million; 0.50% on funds over $2 million; 0.25% on funds over $3 million. These are quarterly. - $25 fee/check written (grants, reimbursements etc.)

- 0.345% annual charge (pass through to investment management fund) for funds in the investment pool.

- RCF can handle additional work (such as marketing) at a rate of $50/hr.