|

RCBJ-Audible (Listen For Free)

|

Town Says LLC Ownership Correlates To Numerous Code Violations, High Rents, and Evictions; Hiding Ownership Upends Centuries Of Precedent

By Tina Traster

If you are a member of an LLC that owns residential property or plans to in the Town of Clarkstown, here’s what you need to know.

The Town Council unanimously passed a local law that requires LLCs (Limited Liability Companies) and corporate entities owning residential properties to disclose a raft of personal information to the town’s building department. All of the LLC’s “beneficial owners” of residential real estate must file their full legal name, residential street address, phone number, date of birth, and driver’s license or passport number within 90 days of the laws effective date — the date the law is filed with the Secretary of State.

Town officials seemed in a terrible rush to pass this law, though it is not clear what was so urgent. New York State is contemplating a similar law that both the Assembly and the Senate have signed off on and is awaiting Gov. Kathy Hochul’s signature. However, the pending New York State Law is not nearly as draconian as Clarkstown’s law. In Clarkstown, a “beneficial owner” owns more than 5 percent of the LLC, whereas under state and federal law, a beneficial owner is defined as someone who owns 25 percent of the LLC.

Also, Clarkstown defines “beneficial owner” more broadly, doesn’t include the same exemptions, and the state version is more protective of the beneficial owner’s personal information.

Clarkstown’s draft law provided for general public access to the owner’s filings. In a last minute compromise, when a resident pointed out the delicacy of privacy issues and potential identity theft concerns, the town said it would modify the law to protect social security numbers and financial information – neither of which need be disclosed.

New York’s law would limit disclosure to names and addresses on a public database.

The federal version of this law, called the Corporate Transparency Act, goes into effect January 2024. All corporations and LLCs nationwide, with some exceptions, are subject to this law, which requires LLCs to report their “beneficial owners.” The federal law does not provide for any public disclosure of personal information.

When asked whether the law is prospective only, Town Attorney Craig Johns said it was, but the plain language of the newly adopted law states it applies to all entities that own residential real estate under an LLC, not just to new acquisitions.

The law provides: “All entities that own residential real estate in the Town of Clarkstown are considered reporting companies…and must file with the Building Department of the Town of Clarkstown within 90 days.”

In the pending state version, there’s a $250 one-time fine for not registering after two warnings. In Clarkstown, there’s a minimum fine of $3,500 per week for noncompliance, plus the town’s attorney’s fees and costs. Therefore 90 days after the law is sent to the secretary of state, hundreds of LLCs will need to register their information or face exorbitant fines.

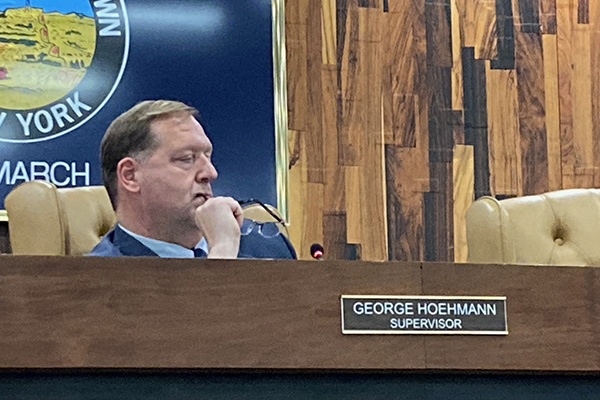

Even before public comment last Tuesday, Supervisor George Hoehmann said, “We want to pass this law tonight.” Little stood in the way of that goal. Only a couple of people spoke up in the public hearing. There was little discussion among council members.

The law, which applies to residential real estate of any size — from a single-family home to an apartment complex — is designed to prevent owners from hiding behind LLCs or corporations. Town policy makers believe there’s a correlation between anonymous ownership and code violations, high rents, and evictions. They charge that anonymous ownership hampers code enforcement and believe that LLC ownership “upends centuries of precedent by obscuring the answer to the question: who owns what?”

The law specifically allows the public to access the database by filing a Freedom of Information Request. Critics raised the issue that access to sensitive information could result in identity theft or harassment of members of LLCs, who are not actually responsible for code violations. Rather, it is the LLC that’s responsible as the owner. Critics questioned whether the law was rationally related to its stated purpose – curbing code violations, high rents and evictions.

Town resident Laura Bidon, who runs Clarkstown CUPON, spoke in favor of the law.

“Hopefully this law will help town code enforcers identify owners and hold them accountable for their properties,” said Bidon. “LLCs are purchasing house after house. Many are then converted into rental units; some are illegally converted into boarding houses or multi-family units. Many are falling into disrepair or are otherwise violating Town codes.”

Critics fear the law will adversely impact the local real estate market because the registry will act as a deterrence to law abiding owners and others who prefer anonymity in their investment decisions. Many developers and investors prefer to do business as an LLC and may look elsewhere if developing in Clarkstown requires disclosure of their personal information. Critics also fear selective enforcement and bias in its implementation.

The town next month is expected to expand this new law to include disclosures from any LLC seeking a building permit or approval from a land-use board.