|

RCBJ-Audible (Listen For Free)

|

HGAR’s 2023 SECOND QUARTER REAL ESTATE SALES REPORT

Rockland County gained a 1.1 percent increase in the single-family home median price; Inventory In County Down 26 Percent

While demand for home-buying remained robust in the second quarter of 2023, buyer confidence had been shaken by the banking crisis, high interest rates, inflation, and economic uncertainty. Second quarter results indicate that these issues remain a concern for both home buyers and home sellers in the Hudson Valley and across the nation.

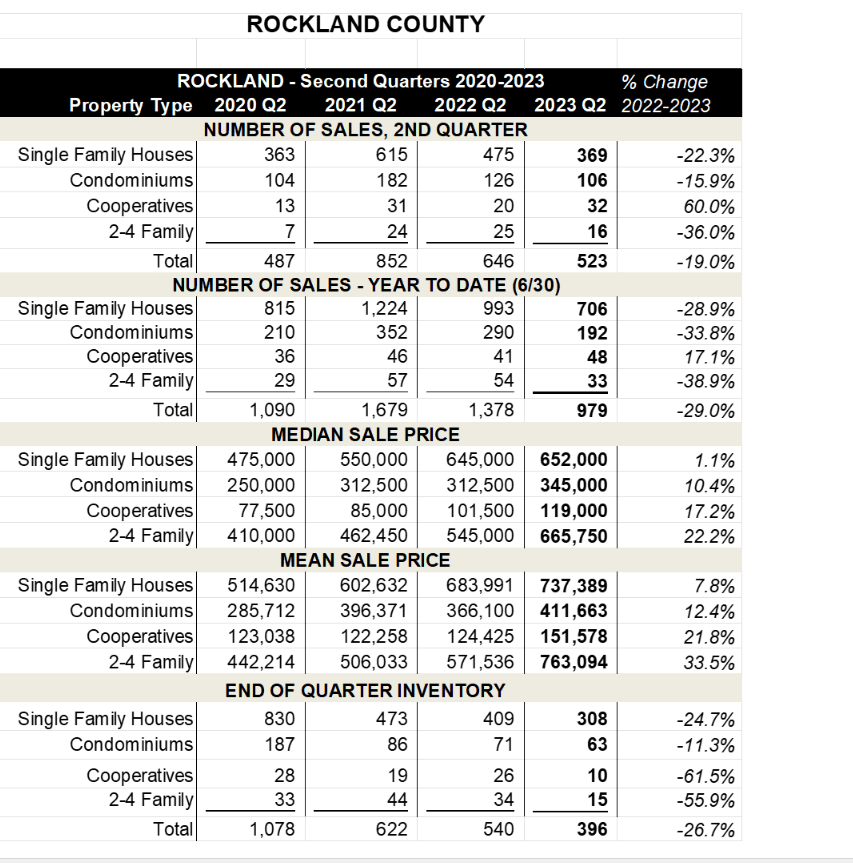

The second quarter 2023 regional data showed lower sales and stabilizing prices in reaction to high interest rates. Inventory levels plummeted in the region, giving home buyers fewer purchase options. The number of residential sales, including single-family homes, condominiums, co-operatives, and two to four-unit multi-family homes, dipped across the board in the second quarter of this year compared to the second quarter of 2022, with Westchester and Sullivan counties experiencing the largest sales volume declines at 26.8 percent and 26.9 percent, respectively. Rockland County residential sales declined 19 percent, Putnam County saw a drop of 19.5 percent, Orange County posted a decrease of 19.7 percent and Bronx County’s home sales were 20.3 percent lower.

One bright spot in the second quarter of this year was the niche co-operative market in Rockland County, which jumped 60 percent in the number of transactions compared to the second quarter of last year.

While sales numbers declined, median sales prices continue to rise for multi-family properties.

While sales numbers declined, median sales prices continue to rise for multi-family properties.

In Rockland, Putnam, Sullivan and Orange counties, median sale prices increased for all property classes, with Rockland County showing a 22.2 percent increase in the multi-family median sale price to $665,750, and a 34.7 percent increase in Orange County’s multi-family median sale price to $409,000. Bronx County saw a decrease in median sale price across all property classes, with the largest decrease being 22.8 percent in the co-op market to $192,500.

Single-family home prices seem to be stabilizing.

Putnam County posted a 2.6 percent increase in the second quarter of this year to $492,500; Rockland County gained a 1.1 percent increase in the single-family home median price to $652,000. Orange County’s single-family median was flat with just a 0.2 percent increase in the second quarter of 2023 to $415,655. Bronx County’s single-family median declined 2.9 percent to $602,000, while Sullivan County posted the largest increase at 7.7 percent, which pushed the median price to $280,000.

Total inventory levels (all property types) in the second quarter of 2023 were down sharply in all markets compared to the same period a year ago led by Putnam County’s 65.2 percent decline; followed by Westchester (-31.4%); Orange County (-29.6%); Bronx County (-26.9%); Rockland County (-26.7%); and Sullivan County (-13.3%).

The Average Days on Market for single-family homes in the HGAR market area increased by double digits except Sullivan County, which saw a 3.5 percent decline to 70 days. Putnam County’s Average DOM shot up 54.5 percent to 70 days, followed by Rockland County’s single-family market, which registered a 47.6 percent hike in Average DOM to 43 days in the second quarter. Orange County single-family homes stood on the market for an average of 61 days in the second quarter, a 27.7 percent hike from last year. Bronx County posted a 21.6 percent jump in Average DOM to 80 days, while Westchester County listed single-family homes were on the market for sale for 42 days, a 21.3 percent increase from the second quarter of 2022.

While the regional economy continues to show strong job growth and low unemployment, national trends provide a mixed-bag forecast. While a recent jobs report show the national economy beginning to slow down, the Federal Reserve Board, which paused interest rate hikes in June, appears likely to hike rates once again at its meetings later this month.

The Mortgage Bankers Association reported that for the week ended June 30, 2023, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.85 percent from 6.75 percent the prior week, while the average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $726,200) increased to 6.95 percent from 6.91 percent the prior week.

MBA Chief Economist Mike Fratantoni said in reaction to the jobs report, “The incoming economic data has been filled with conflicting signals. Manufacturing activity remains quite weak, while consumer spending has held up somewhat better, and new home construction and sales have picked up. Our forecast is for a slowdown in economic activity in the second half of 2023, with a recovery in early 2024. The June employment report reinforces that forecast.” He added that while job and wage growth are trending lower, “both are still well above the pace that would be consistent with the Federal Reserve’s inflation target. We now expect that the Federal Open Market Committee (FOMC) will raise the federal funds target another 25 basis points at its July meeting.”