|

RCBJ-Audible (Listen For Free)

|

Housing Market In Hudson Valley Struggling Though Median Sales Prices Continue to Rise in Rockland, Westchester and Orange Counties

2023 FIRST QUARTER REAL ESTATE SALES REPORT

After a rocky end to 2022, the real estate industry was poised for a better market performance in early 2023. They have been disappointed.

Housing data in Westchester, Putnam, Rockland, Orange, Sullivan, and Bronx counties paints a darker picture, even when compared to pre-pandemic numbers. While the cyclical nature of the residential market normally results in low sales in the first quarter ahead of the traditional “spring selling season,” the numbers show a market that continues to struggle due to high interest rates and low inventory, according to real estate professionals.

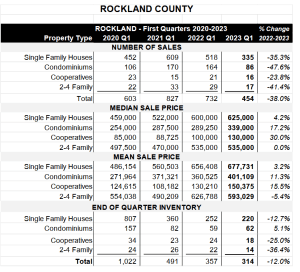

Rockland County was particularly hard hit when considering total residential sales, which include single-family homes, condominiums, cooperatives, and two-to-four-family multi-family homes. Leading the pack, Rockland experienced a 38 percent drop compared to a 32.7 percent decline in Westchester County.

Further north, Putnam County saw a decrease of 31.7 percent, Orange County’s sales dropped 35.1 percent and Sullivan County’s sales were down 31.6 percent. Bronx County saw the smallest decrease in Q1 residential sales, at 24.8 percent.

On the upside, however, single-family median sales prices continued to rise in Westchester County (4.3 percent), Rockland County (4.2 percent) and Orange County (5.2 percent).

In contrast, Putnam County saw a 5.3 percent decrease in the median sale price, Sullivan County, a 5 percent decrease, and Bronx County a 2.5 percent decrease.

For Q1 2023, the median sales price for single-family homes in Westchester County led the way with $760,000, Putnam County was $450,000, Rockland County was $625,000, the median sales Orange County $394,500. The median sales price in Sullivan County was $254,500, and the median sales price for single-family homes in Bronx County was $585,000.

The stats were not encouraging for average days on the market (DOM), especially for two to four-family multi-family properties, signaling a slowdown in demand. Sullivan County experienced a 41.6 percent drop. Rockland County saw a 31.4 percent decrease and Putnam County saw a 26 percent decrease in the same property category.

In contrast, Bronx County and Orange County saw an increase in DOM for all property classes this quarter, and Westchester County saw an increase in all categories except for condominiums, which had a marginal decrease of 0.7 percent.

Available inventory continues to fluctuate, with inventory depressed in all markets except for Orange (11.3 percent) and Bronx (2.9 percent) counties, compared to availability at the end of Q1 2022. However, most of the HGAR market area saw already low inventory levels continue to decline as compared to a year earlier, with Putnam County’s inventory falling 34.9 percent, followed by declines in Westchester (18.6 percent), Rockland (12 percent) and Sullivan (6.5 percent).

Looking forward, on the plus side of the ledger, HGAR professionals say buying demand remains high even though their confidence has been shaken by the recent banking crisis, high interest rates, inflation, and predictions by some economists of an impending downturn or recession later this year.

But they are heartened by some recent good news including the decline in mortgage rates, and predictions that the Federal Reserve may be nearing the end of its policy of raising rates to battle inflation. NAR Chief Economist Lawrence Yun recently said, “Though week-to-week rate changes can move up and down, the longer-term prospect on rates is for further improvement, with a clear possibility of going under 6 percent by the year’s end. This is because, with so much apartment construction, the new empty units steadily hitting the market will limit rent growth and calm overall consumer price inflation. The Federal Reserve can therefore stop tightening. With lower rates, more homebuyers will steadily appear. That is why it is critical to ensure more housing supply to help meet the recovering demand.”