|

RCBJ-Audible (Listen For Free)

|

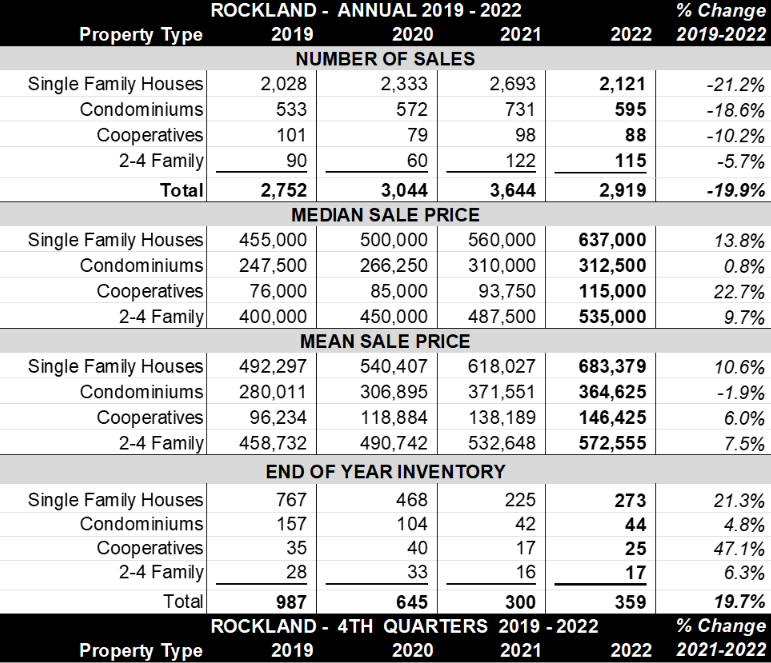

Rockland County Sales Fall 20 Percent in 2022 Compared to 2021

REAL ESTATE

Rising interest rates stole some of the euphoria out of the go-go residential real estate market but there were still trends to celebrate, namely the number of units sold in 2022 exceded those of the 2019 pre-pandemic market.

Total residential sales in the Hudson Valley counties decreased year-over-year, with Rockland County experiencing a near 20 percent fall over last year (2,919 units in 2022 compared to 3,644 in 2021.

That trend remained consistent throughout Westchester and the Hudson Valley.

Westchester County sales decreased 12.6 percent (10,367 units compared to 11,866 in 2021); Sullivan County 15 percent (1,188 units compared to 1,398 in 2021); Orange County nearly 16 percent, and Putnam County declined 20 percent (1,277 units compared to 1,607 in 2021).

In contrast, Bronx County decreased only 3.3 percent (2,485 units compared to 2,571 in 2021

Sales of single-family residential units year-over-year decreased across the board.

The median price of a single-family residence rose in every county, with the greatest gain of nearly 14 percent increase in Rockland County – to $637,000 this year from $560,000 in 2021. However, Rockland County’s single-family home sales decreased by 21.2 percent for the year to 2,121 units (compared to 2,693 in 2021).

The single-family median sales price of $660,000 for the third quarter of 2022 in Rockland County was 14.2 percent higher than 2021.

Westchester County, with the highest prices in the region, had the smallest percentage increase in the median single-family home price at 4.5 percent ($815,000 compared to $780,000 in 2021).

Putnam County saw its single-family median price rise 11.3 percent to $489,500 (from $440,000 in 2021), yet Putnam County had the largest percentage drop of nearly 22 percent in single-family home sales year-over-year (1,074 units vs. 1,375 in 2021).

Orange County gained a 9 percent increase in its single-family median price to $400,000 (from $367,000 in 2021) but saw a -15.6 percent decrease in sales (3,754 units compared to. 4,450 in 2021).

The Bronx County had a marginal percentage decrease of 3.8 percent (691 units compared to 718 in 2021).

In the more affordable condominium and cooperative sector, Westchester County posted 1,488 condominium sales in 2022, down -10-5 percent from the previous year and 2,125 cooperative transactions, just -0.4 percent less than 2021’s sales activity. The median sale price of a condominium in Westchester County rose 5.9 percent last year to $450,000, while the median price of a cooperative remained relatively flat at $195,000, a 1 percent increase from 2021.

Sales of condominiums and cooperative units in Rockland County fell 18.6 percent and -10.2 percent respectively in 2022 as compared to 2021. The median sale price of a condominium in Rockland County rose less than 1 percent, to $312,500 in 2022, while the median price of a cooperative rose sharply by 22.7 percent last year to $115,000.

Condominium sales in Orange County fell by 15.9 percent in 2022 compared to the previous year, while the median price of a condo rose 13 percent to $260,000.

When focusing solely on the fourth quarter residential sales numbers, there were significant decreases in the number of residential sales in all counties when comparing the 2022 fourth quarter to the 2021 fourth quarter sales. Rockland County saw fourth quarter 2022 sales (663 units) fall short of fourth quarter 2021 sales (995 units) by more than a third.

Putnam County saw fourth quarter 2022 sales (291 units) fall short of fourth quarter 2021 sales (393) by 26 percent. Westchester County’s overall sales of 2,140 units were 25.5 percent below fourth quarter sales activity in 2021.

Single-family homes were selling below list price in all counties north of Westchester and Rockland, and they averaged a higher number of days on the market than fourth quarter 2021 in most counties, except for Westchester and Sullivan counties. Lack of inventory continues to be a problem with no meaningful resolution on the near horizon. With the Fed tightening monetary policy it is expected that mortgage rates will stabilize in 2023.

The real estate market in the New York City area and the lower Hudson River Valley, is expected to continue to see lower sales and tight inventory in the short term, however, most analysts believe market conditions will begin to improve in the second and third quarters of 2023, according to HGAR.

National Association of Realtors Chief Economist Lawrence Yun recently noted that the real estate investment component of GDP has fallen for six straight months.

“There are approximately two months of lag time between mortgage rates and home sales,” he said. “With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth.”