|

RCBJ-Audible (Listen For Free)

|

But Real Estate Transactions Plummet Due To Low Inventory

REAL ESTATE

The real estate market in the lower Hudson River Valley and greater New York City suburban area continued to be battered by chronic low inventory, rising interest rates and persistent inflation during the 3rd quarter of 2022.

However, even given these adverse conditions, resiliency and consistent buyer demand are still evident, especially when compared to the pre-pandemic market of 2019, according to HGAR, the Hudson Gateway Association of Realtors.

While total transactions are down from the previous year, median sales prices continue to increase throughout the market, driven in large part by low inventory.

“We also are likely experiencing a return to a more seasonal market, which disappeared during the latter half of 2020 and the entirety of 2021,” said a HGAR spokesperson.

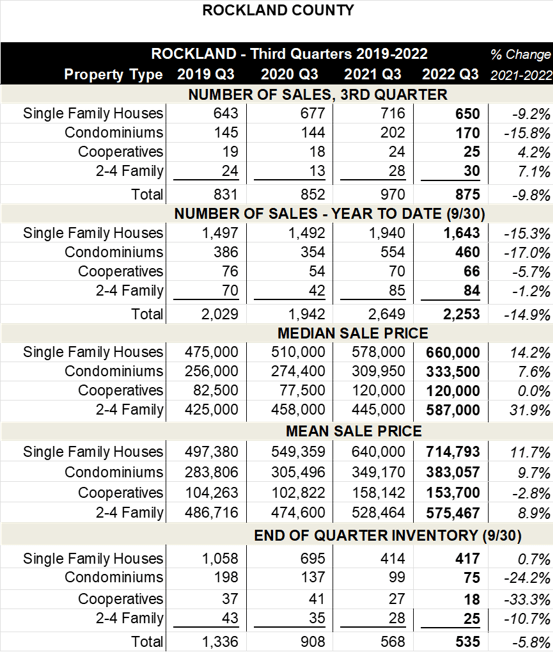

The single-family median sales price of $660,000 for the third quarter of 2022 in Rockland County was 14.2 percent higher than 2021.

Rockland County showed a drop in transactions, with single-family home sales down 9.2 percent and condo sales down 15.8 percent; however compared to third quarter of 2019, the 2022 quarter numbers are slightly ahead.

In Westchester, the single-family median sale price of $872,000 posted a 2 percent increase over last year. But the condo median sales price of $460,000 was slightly down, and the co-op median sale price of $204,500 was 2.3 percent higher than the previous year.

In Westchester County, third quarter single-family home sales of 2,006 declined 15.6 percent compared to the third quarter of 2021. However, when compared to the third quarter of 2019, single-family home sales in Westchester were up 3.4 percent. Condo sales in Westchester for the third quarter of 2022 decreased by 24.5 percent and co-op sales were on par with the previous 3rd quarter.

In Putnam County, the median sales price of $505,000 was 8.6 percent higher than the third quarter of 2021. Single-family home sales of 326 were down 10.7 percent compared to the third quarter of 2021, but when compared to 2019, the number of sales were almost identical.

In Orange County, the single-family home median sales price was up 9.1 percent at $420,000 and the median condo sales price of $270,950 for the third quarter was a 13.4 percent increase over the 2021 third quarter. The 3rd quarter single-family home sales number of 1,019 was down 14 percent over the 2021 second quarter, and the condo sales number of 138 was off an even steeper 23.3 percent.

In Sullivan County the single-family sales number of 300 transactions was just slightly higher than the 298 total of the previous year and the median sales price was up more than 10 percent percent when compared to the 3rd quarter of 2020.

Shifting closer to the city, the Bronx market continued to show signs of strength in the 3rd quarter of 2022, with single family home sales ahead 9.2 percent over the 3rd quarter of 2021. The median sales price of $630,000 was 6.8 percent ahead of last year. However, condo sales lagged from the previous 3rd quarter.

HGAR anticipates ongoing challenges in comparing sales numbers to the pandemic year of 2020, when the market came to a grinding halt in the second quarter and the post-pandemic market of 2021, when pent up demand drastically sped up typical buying cycles.

“Given the grim drumbeat of negative economic headlines and the ongoing debate of will there or won’t there be a recession, it’s obvious that the market will not be immune to such significant headwinds,” said a HGAR spokesperson.

The trade group says third quarter sales numbers do not necessarily support the doom and gloom forecasts many prognosticators are making. The strong labor market seems to be playing a role in counterbalancing some of the adverse economic factors. As was the case at the end of the second quarter, the wild card in this analysis is a potential recession in 2023, and the length and depth if one does occur.

Until then, the numbers support a conclusion of a resilient real estate market that is hampered by low inventory but still supported by strong buyer demand.