|

RCBJ-Audible (Listen For Free)

|

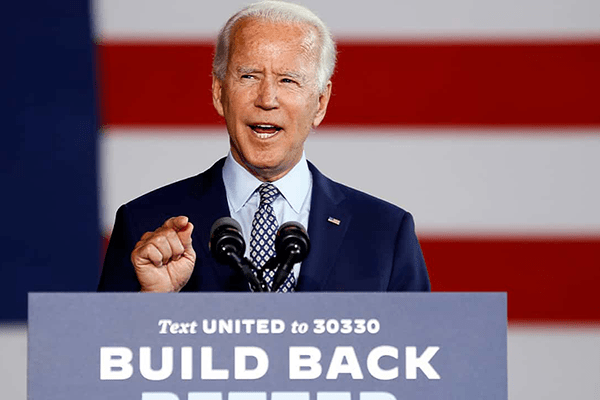

Administration Considering Rolling Back Plans For Real Estate Investors With Incomes Exceeding $400,000

By Judith Bachman

With a change of administrations, real estate investors and landlords must remain alert for policy changes that could impact their assets. President Biden’s plan to eliminate the 1031 exchange program for real estate investors is one such threat. In view of the threat, commercial real estate owners must review their portfolio and may want to accelerate plans to rebalance it, as appropriate.

A 1031 exchange is a swap of one investment property for another. With a 1031 exchange, instead of cashing out from a sale, the real estate owner reinvests the proceeds into another property.

A 1031 exchange is a swap of one investment property for another. With a 1031 exchange, instead of cashing out from a sale, the real estate owner reinvests the proceeds into another property.

The phrase 1031 exchange gets its name from IRS code Section 1031. To qualify to defer gains as a 1031 exchange, the transaction must meet certain criteria. That criteria includes (1) the properties being swapped are both used for business or investment purposes, (2) the properties being exchanged must be considered ‘like-kind’ by the IRS, (3) the sale and purchase occur within time limits of each other, and (4) the proceeds from the sale are held in escrow by an intermediary pending the swap purchase.

Commercial real estate owners use 1031 exchanges to allow the profits from their real estate investments to grow tax deferred. As there is no limit to the number of times an owner can use a 1031 exchange, they can rollover the gain from one piece of investment real estate to another, repeatedly, without having to pay gains tax at each instance. Only when/if the owner eventually sells the last property for cash, would capital gains tax be due.

Biden’s policy proposal, entitled “The Biden Plan for Mobilizing American Talent and Heart to Create a 21st Century Caregiving and Education Workforce,” states it will be paid for by “rolling back unproductive and unequal tax breaks for real estate investors with incomes over $400,000.” Officials have stated that they will take aim at “so-called like kind exchanges,” leading experts to believe the 1031 exchange program could be eliminated for high-income earners.

The elimination of this program for high-income investors could have unintended consequences for the commercial real estate market. For instance, if it is eliminated, some investors might hold on to properties for longer than in the past and it would thereby have the effect of decreasing supply and demand.

Whether the new administration eliminates the 1031 exchange program or not remains to be seen. Commercial property owners must remain vigilant to the risks that such a policy change would pose and should proactively consult their tax advisors now. So long as the window for 1031 exchanges remains open, they should continue to take advantage of it.

Judith Bachman is the founder and principal of The Bachman Law Firm PLLC in New City. judith@thebachmanlawfirm.com 845-639-3210, thebachmanlawfirm.com