A partnership between Onyx Equities and global investor Angelo Gordon nabbed $94 million from Bank of America to help fund its $116.8 million purchase of Bradley Corporate Park in Blauvelt, according to information from brokerage Cushman & Wakefield, which arranged the debt.

The joint venture completed an all-cash purchase of the 17-building industrial park in May, because of timing restrictions, and then secured the Bank of America financing about 90 days after the purchase, according to a representative of Cushman (C&W).

A C&W equity, debt & structured finance team led by John Alascio, Gideon Gil andSteve Kohn, along with Sridhar Vankayala, Zachary Kraft and Emily Johansen, represented the joint venture in arranging and securing the debt.

“This transaction represented an exceptional opportunity for lenders given the experienced sponsorship profile and value-add nature of the deal,” Alascio said in a prepared statement. “The industrial park has significant upside through management efficiencies and institutionalizing the rent roll. [Onyx and Angelo Gordon] acquired the portfolio well equipped to introduce a capital plan to upgrade the buildings and cure deferred maintenance, renew and extend existing tenants and bring the park to an institutional standard.”

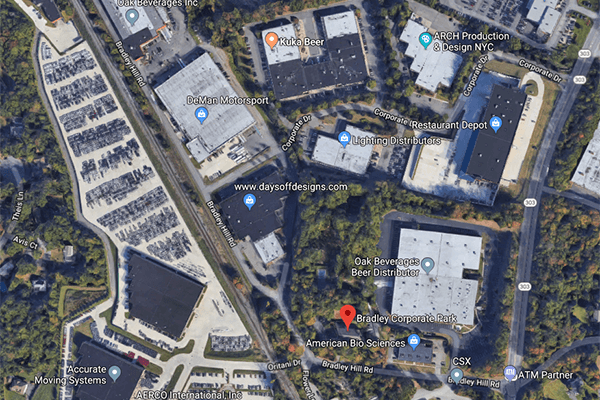

The property, which spans nearly 1.2 million square feet across 180 acres, is located at 500 Bradley Hill Road in Blauvelt, New York.

CBRE’s Brad Cohen, Jacob Tzfanya and Jon Kamali, along with Brian Fiumara of CBRE National Partners, represented the joint venture in the purchase, according to a May report from Real Estate New Jersey. Tzfanya said that the portfolio is nearly 90 percent occupied, according to Real Estate New Jersey’s report.