A GPS For Your Finances

By Ken Mahoney

So far this year the three main indexes, the DJIA, S&P and NASDAQ are up 2.56%, 1.88% and 6.33% respectively. It has been somewhat of a roller coaster ride for investors this year, but led by a strong economic outlook, the markets are on track to accelerate into the final months of the year. As

we look forward, the economic climate will continue to feel unsettled, but investors should not be fearful.

We think volatility will continue to play a big part in the market.

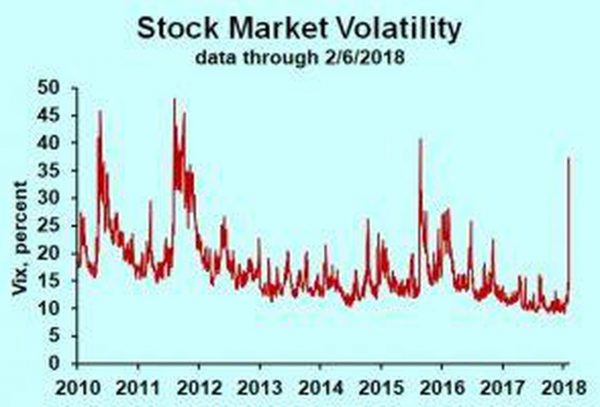

Volatility has been a major focus for investors throughout 2018 and with levels of fluctuation mirroring those of 2008 it is a topic we need not shy away from as it presents opportunities for the active investor. Measured by the CBOE Volatility Index, or VIX, a real-time index that represents the market’s expectation of 30-day forward fluctuations, figures are derived from the price inputs of the S&P 500 index. For investors, the VIX provides measures of market risk and fear within a market and as a result can have a significantly impact an individual’s portfolio.

We started the year off with high volatility levels caused by the February sell off, the DOW lost over 3000 points, or 12% in just two weeks. The VIX spiked over 37, reaching levels not seen since 2015. The effect to the average investors portfolio obviously depended on the make-up of assets, but by and large returns dropped and presented a buying opportunity for investors to pick up solid companies at good value and therefore individuals with higher levels of cash were rewarded.

We recently experienced similar levels of volatility through ‘Red October’ thanks to a mixture of company earnings reports, China trade talks, upcoming mid-term elections as well as the Federal Reserve continuing to raise rates. Volatility may feel uncomfortable, but market fluctuations are normal. That perspective becomes especially relevant through October, which is considered the most volatile month for markets. An indicator of fear, volatility doesn’t predict the returns of the market and as an investor we suggest it is a time to act rather than do nothing. Adding to your portfolio during these times allows for a greater chance of benefiting in the long run, by entering at low prices and utilizing the buy-and-hold strategy.

Looking ahead to the new year, we think volatility will continue to play a big part in the market. With the Fed continuing to raise rates and concerns around China trade talks and Brexit, we are urging investors to make volatility their friend, not foe. We like to advise investors to be active during these times, (not day traders) but active investors as solid, large-cap growth stocks such as the FANG stocks, (Facebook, Amazon, Netflix and Google) continue to trade at cheap prices. Our hybrid strategy will remain of 70% long, large cap growth and 30% active trading.

Investor, author of 7 books including Life On Your Terms, and licensed financial advisor for more than 27 years, Ken Mahoney is the CEO of Mahoney Asset Management . To get a free copy of the e-book, call 845-371-0101.