September 27, 2018 – By Paul McCormick, SVP – Investment Sales & Capital Services, Ariel Property Advisors

The U.S. Federal Reserve, as widely expected, raised its benchmark short-term interest rate by a quarter-percentage point to a range of 2.00% to 2.25% on Wednesday, its third increase this year and eighth since December 2015. At the end of its two-day policy-setting meeting, Federal Reserve officials kept their monetary policy outlook mostly unchanged, with another rate hike penciled in for December.

“The labor market’s strength could create inflationary pressures through stronger wages but for now inflation remains tame, so there is little need for the Fed to change its stance on interest rates at this juncture,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services.

According to the Fed’s September statement, “The labor market has continued to strengthen … economic activity has been rising at a strong rate,” removing its longstanding reference to the fact that monetary policy remained “accommodative.” This is significant given the term “accommodative” has been used by the Fed for most of the past decade.

The U.S. economy is irrefutably on solid footing, which should keep the central bank on track to continue raising rates, with one more increase expected this year. Forecasters almost unanimously contend that unless inflation picks up or the economy starts slowing, the federal funds rate will continue to head higher in 2019.

The labor market is by far the economy’s biggest bright spot. The jobless rate in August stood at 3.9%, its lowest level since the beginning of the century, and unemployment benefits have been hovering around 48-year lows. Tightness in the labor market is making an impact on paychecks too, with average hourly earnings in August rising at the best rate since the end of last decade’s recession in 2009.

“The labor market’s strength could create inflationary pressures through stronger wages but for now inflation remains tame, so there is little need for the Fed to change its stance on interest rates at this juncture,” said Paul McCormick, Senior Vice President of Investment Sales and Capital Services.

The consumer price index, a gauge of underlying U.S. inflation, unexpectedly cooled in August. Buoyed partly by President Trump’s $1.5 trillion tax cut, consumer spending, which accounts for roughly 70% of the economy, has ramped up in recent months. Indeed, gross domestic product – the broadest measure of goods and services produced in the U.S. – was 4.2% in the second quarter, significantly above the first quarter’s 2.2%. The Atlanta Fed, widely viewed as one of the most reliable predictors of GDP, is currently forecasting 5% growth in the third quarter.

“Investors have become increasingly sanguine about the economy and believe trade disputes, particularly with China, along with geopolitical turmoil overseas, won’t disrupt growth,” McCormick said.

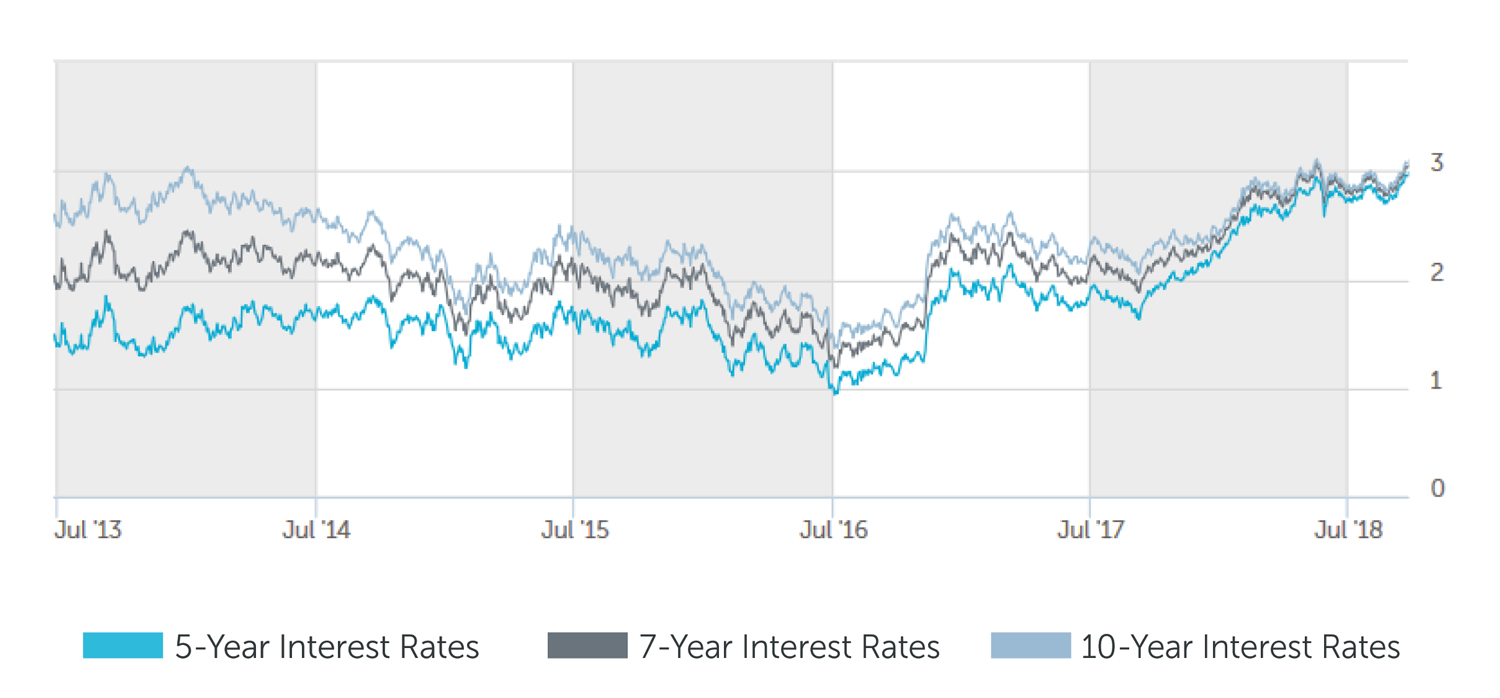

This cheerfulness has spurred “risk on” trades, causing the stock market to reach new highs and safe-haven Treasuries to sell off. The 10-year Treasury yield, last trading at 3.08% is approaching levels not seen in seven years. Yields could head higher should inflation, which diminishes the value of the fixed-payments made on long-dated bonds, accelerate.

It has undeniably become more expensive to finance real estate transactions, but balance sheet lenders have already reflected higher rates. However, the prime rate -– used for an array of credit, such as student loans, auto loans, home loans, credit cards, construction loans and some bridge loans – is pegged to the Fed’s benchmark lending rate by 300 basis points.

“Every move higher by the Fed is making an impact on the cost of living, something worth keeping an eye on,” McCormick said.

Overall, Fed monetary tightening reflects optimism about the economy, and while interest rates have risen, they remain historically low. At the same time, new alternative lenders, both individual and institutional, have emerged with a keen desire to extend credit. We therefore expect capital markets to remain active, allowing investors unfettered access to attractive and dependable financing.

MULTIFAMILY LOAN PROGRAMS

| Portfolio Lenders | |

| Term | Interest Rates |

| 5 Year | 4.125% – 4.375% |

| 7 Year | 4.375% – 4.625% |

| 10 Year | 4.50% – 4.75% |

| Agency Lenders | |

| Term | Interest Rates |

| 5 Year | 4.25% – 4.50% |

| 7 Year | 4.50% – 4.75% |

| 10 Year | 4.75% – 5.00% |

Pricing current as of 9-26-2018 and varies with LTV and DSCR

| COMMERCIAL LOAN PROGRAMS | |

| Term | Interest Rates |

| 5 Year | 4.75% – 5.00% |

| 7 Year | 5.00% – 5.25% |

| 10 Year | 5.25% – 5.50% |

| Construction / Development / Bridge | |

| Term | Interest Rates |

| Construction / Development | 5.75% – 7.00% |

| Stabilized | 6.00%-7.50% |

| Re-Position | 9.00%-11.00% |

Pricing current as of 9-26-2018 and varies with LTV and DSCR

| Index rates | |

| Index | Interest Rates |

| 5-Year Treasury | 2.96% |

| 7-Year Treasury | 3.04% |

| 10-Year Treasury | 3.08% |

| Prime Rate | 5.00% |

| Swaps | |

| Term | Interest Rates |

| 3-Year Swap | 3.07% |

| 5-Year Swap | 3.11% |

| 7-Year Swap | 3.11% |

| 10-Year Swap | 3.14% |

Pricing current as of 9-26-2018

TREASURY RATES