|

RCBJ-Audible (Listen For Free)

|

Four Years Of Over-Assessments Could Cost Clarkstown and School District Tens Of Millions In Refunds, Interest & Lost Future Revenue

A court battle between Eklecco, the owner of the Palisades Center, and the Town of Clarkstown over four years of property tax challenges is set for trial beginning Tuesday, March 19th, before the Honorable Christie D’Alessio in Rockland County Supreme Court.

According to Eklecco’s counsel, “The primary issue remaining in these proceedings is not whether the Palisades Center was over-assessed, it is by how much.”

The Palisades Center is challenging four years of what it calls “illegal and inflated tax assessments.” If successful, it may be entitled to tens of millions of dollars in tax refunds, plus interest going back four years.

Potential financial consequences to both the Town of Clarkstown and the Clarkstown Central School District (which is an intervenor in the suit) are reminiscent of North Rockland School District’s settlement with Mirant Energy, the largest tax certiorari in New York State history. North Rockland is still paying off a $275 million settlement of the tax certiorari cases dating back to 2006. Payments of $11 million per year have devastated the finances of the school district and are set to continue through 2037.

The Palisades Center, the largest taxpayer in Clarkstown, has over the past few years been weakened by online shopping, closures of anchors like Lord & Taylor, J C Penney, Bed Bath & Beyond and other big box stores, and from the COVID-19 shutdowns. The Palisades Center pays more than $22 million per year in property taxes and assessments.

From 2020 through 2023, Pyramid has filed tax certiorari cases in Rockland County Supreme Court after Clarkstown rejected its tax assessment challenges. The four cases have been consolidated and are set for trial beginning tomorrow. The trial will continue through March 28th, begin again on April 29th and continue through Mary 9th, and then, if still not completed or resolved, begin again on May 20th.

The parties have reached some agreements in advance of trial, dismissing disputes in two of the forty-five parcels, and agreeing to a valuation on one parcel. There is no agreement on the proper assessment of the other 42 parcels. The land covers 177 acres and 2.876 million square feet of gross building area.

The parties also agree the appropriate method of valuing the property is a direct capitalization approach, which means multiplying the net income earned from the property by a capitalization rate to determine a fair market value. Capitalization rates are economic multipliers determined by a number of factors including interest rates, values of similar properties, economic risks and demographic trends.

The parties are coming to trial armed with their respective appraisals based largely on audited financial statements, reviews of comparable properties, sales and leasing experiences for the relevant time periods, investment in tenant buildouts, valuations placed on similar tenant mixes in other malls, demographics and physical settings.

According to Eklecco’s counsel, “The primary issue remaining in these proceedings is not whether the Palisades Center was over-assessed, it is by how much.”

In appraisals and court filings, the town’s expert witness, Sharon Locatell of Appraisers & Planners, Inc., essentially acknowledged the Palisades Center properties were over-valued between 2020/2021 and 2023/2024 by more than $300 million. Eklecco’s experts put the over-valuation at more than $1.2 billion.

If Eklecco prevails, the Clarkstown School District could owe over $50 million in refunds and lose future tax revenue of $30-$35 million over the next three years. The town would similarly owe tens of millions of dollars in refunds and interest on the refunds, and lose future tax revenues. Interest on refunds accrues from the date the taxes were paid until a final order is entered in the case. Either side is entitled to appeal an adverse ruling.

The Court will also have to decide how much evidence to allow in. Each side proffered their expert appraisals, but the town has sought to offer additional evidence challenging the credibility of Eklecco’s experts, which Eklecco argues is not permitted in tax certiorari cases.

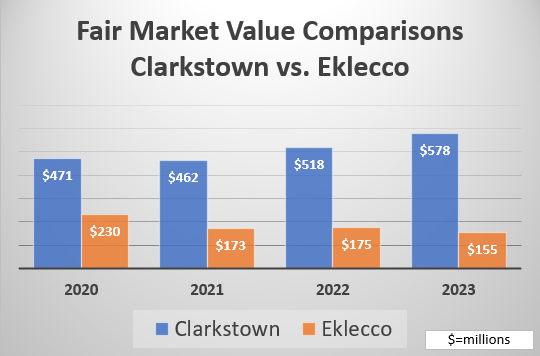

Fair Market Value Comparisons

Clarkstown’s valuation of the mall essentially increased year-over-year while Eklecco’s value decreased.

For calendar year 2020, the town assessed the mall at $140 million based on its determination that the fair market value (FMV) of the property was $471 million. An equalization rate is applied to the FMV to determine the assessed value. Taxes are based on assessed value, not FMV. Eklecco claimed FMV in 2020 was $230 million, less than half of what the town maintained.

For the next three calendar years, the town continued to assess the mall at $140 million based on its determination that FMV was $462 million (2021), $518 million (2022) and $578 million (2023). Eklecco lawsuit claims FMV was $173 million in 2021, $175 million in 2022 and $155 million in 2023.

Eklecco Prevails In Assessment Challenges In Albany County

There may be striking similarities between a tax challenge in Albany County with the one here in Rockland County.

Eklecco/Pyramid, which owns the Crossgates Mall in Albany County in the Town of Guilderland, prevailed in its tax certiorari case in December when the court ordered the 2019 tax assessment to be reduced by $24 million from $282 million to $258 million. For 2020, the court ordered an additional $81 million reduction to $177 million.

Despite the ruling in favor of Pyramid in Albany, both sides filed appeals of the lower court’s decision. Pyramid still has outstanding challenges in Albany against the Town of Guilderland for 2022 and 2023. New York law does not allow an assessment to be disturbed in the three years following a successful tax challenge and Pyramid has sought refunds from the local taxing authorities for those years.

At Crossgates, dozens of stores left at the onset of the pandemic. Others sought rent reductions and concessions to remain. The fall in leasing income led Pyramid/Eklecco to default on a $300 million loan collateralized by the real estate at Crossgates which it has since replaced with new financing.

Last February, Wilmington Trust, acting as a trustee for CMBS bondholders, filed in New York Supreme Court, New York County, to foreclose on the 2.2 million-square-foot shopping and entertainment complex, claiming Syracuse-based owner Pyramid Management Group defaulted on a $418.5 million loan tied to the mall property.

In the tax assessment case, the Town of Clarkstown is represented by John Flannery of Wilson Elser, White Plains. Eklecco is represented by Craig Leslie of Phillips Lytle, Buffalo, NY.