|

RCBJ-Audible (Listen For Free)

|

Report Shows Rockland County Has Declining Sales Tax Revenue In 2023 Compared To 2022; Revenue Rises In All Other Mid-Hudson Counties

For the first time since the COVID-19 pandemic, Rockland County’s collection of sales tax fell — a trend that runs counter to the other counties in the Mid-Hudson region and in New York State.

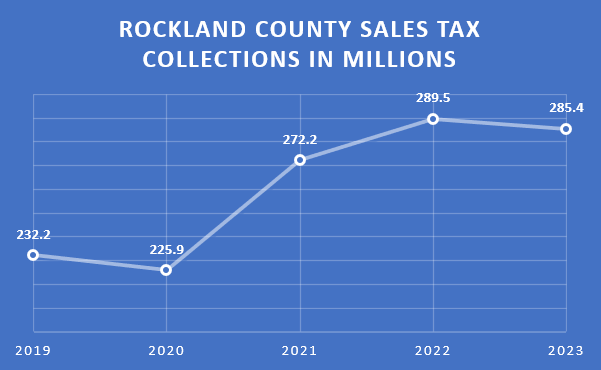

Sales tax collections for Rockland County, according to the New York State Comptroller’s report, fell to $285.4 million in 2023 from $289.5 million in 2022, a decrease of $4.1 million or 1.4 percent. The comptroller’s monthly report does not break down sales tax collections by category so it is impossible to know from the report whether one industry is faltering or if the decrease is spread out among more than one category.

However, the county says the reduction in sales tax collections reported by the comptroller is due entirely to the early elimination of the residential energy sales tax which provided $12 million in revenue annually.

“We eliminated the Residential Energy Sales Tax in 2022 to provide tax relief to our residents,” said County Executive Ed Day. “This elimination reduced our sales tax revenue by $12 million annually beginning in 2023.

State Comptroller Thomas DiNapoli showed New York State overall local sales tax collections increased 4.2 percent in 2023 compared to the sales tax collections in 2022. Collections in 2023 totaled $23 billion, up $919 million over 2022.

In December of 2023, Rockland County collected $27.96 million in sales tax, which represented 9.8 percent of the year’s total collection of $289.4 million. The County had issued a previous statement saying December’s sales tax revenue would close the gap because of holiday shopping. However, the $27.96 million was not enough to close the gap. The last dip in sales tax collection in Rockland County occurred in 2020, the first pandemic year.

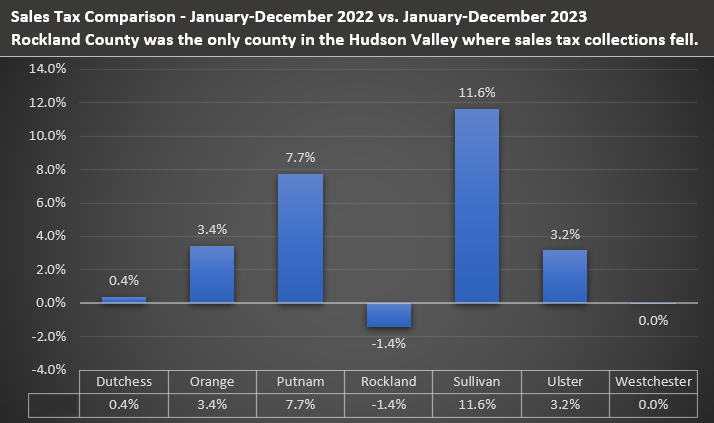

Comparing sales tax collections for the whole of 2023, compared with the whole of 2022, Rockland was the only county of the seven in the Mid-Hudson that saw a decrease in collections when comparing 2023 to 2022. Westchester’s sales tax collections were relatively flat year over year but other neighboring counties saw increases: Putnam (+7.7%), Orange (+3.4%), Ulster (+3.2%) and Sullivan (+11.6%).

Based on the Comptroller’s report, sales tax collections in Rockland County were down 1.4% percent year over year.

Sales taxes are the county’s main source of revenue. The 2024 Rockland County budget anticipates collections of $285 million dollars in sales tax — the same amount the county collected in 2023. For 2023, the county had budgeted $261 million in sales taxes and collections exceeded budgetary expectations.

The Comptroller’s Office tracks sales taxes over time and found that for the twelve months of 2023, compared with 2022:

- New York City’s collections totaled $10.134 billion, an increase of 5.9% over the prior year.

- County and city collections in the rest of the state totaled $11.4 billion, an increase of 2.4%.

- Only 6 out of 57 counties, including Rockland County, experienced year-over-year decreases.

Robust collections in the past have enabled Rockland County to eliminate the Residential Energy Sales Tax, the Motor Vehicle Registration Tax, and facilitated a temporary reduction in the county’s portion of the tax on motor fuel purchases. The county has also been considering eliminating its hotel/motel occupancy tax, according to a source close to the budgeting process.

County Executive Ed Day says the reduction in receipts is attributable to the discontinuance of the Residential Energy Tax, which was counted by the state as part of sales tax collections. The Residential Energy Sales Tax was collected from 2012 through 2022.

Sales tax in Rockland County is 8.375 percent of taxable items like clothing, appliances and cars. Of that, 4 percent is the state’s share, and .375 percent goes to the MTA. The other 4 percent, collected by the county, is shared by Rockland’s towns and villages.

Sales tax allocations are made in accordance with sharing agreements between the counties and their cities, towns, and villages. Sales tax sharing agreements are required when county sales taxes are allocated on a basis other than population. All sales tax sharing agreements must also be approved by the state comptroller.

Shortfalls in county sales tax revenue pass through to the towns as the towns share a percentage of collected revenue. Rockland County shares about 6% of collected revenues with the towns and villages.

Towns and villages depend on that revenue when preparing their fiscal year budgets. Clarkstown budgeted $5.3 million in revenue from its share of 2024 county sales tax. Ramapo budgeted $2.4 million, Orangetown $2.1 million; Stony Point $800,000; Town of Haverstraw $700,00, Village of Haverstraw $320,000.