Pandemic Migration To Suburbs Benefitting Hudson Valley

REAL ESTATE

THIRD QUARTER RESIDENTIAL REAL ESTATE SALES REPORT

Single-family residential sales figures increased across the board regionally with the exception of Bronx County which likely felt the impact of the hard-hit New York City market.

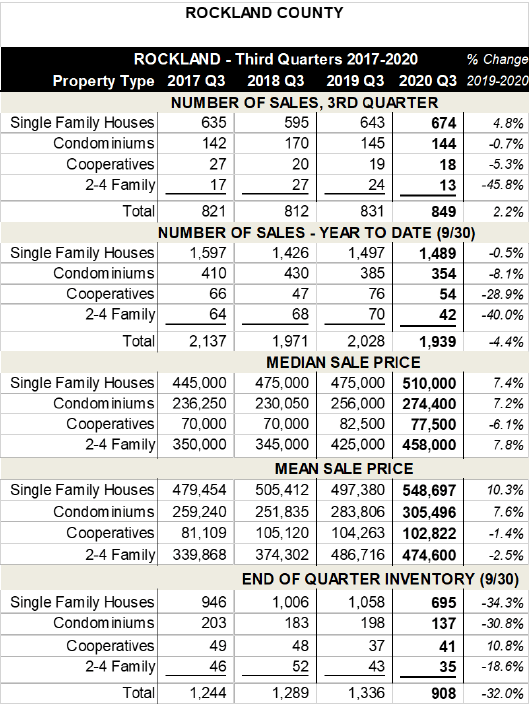

Q3sales in Rockland were up 4.8 percent to 674 units compared to Q3, 2019 when 643 sales took place. Westchester County, the largest county in the region, saw single-family residential sales increase from 1,940 in 2019 to 2,173 in 2020, a 12 percent gain

Meanwhile, Sullivan County experienced a whopping 45 percent increase in sales over the third quarter of 2019 with 384 single family residential units sold compared to 264 units in 2019. Single family residential sales gain in Putnam was 8 percent, 350 sales compared to 323 in 2019. Orange County sales were up 7.9 percent. There were 1190 sales in Orange as compared to 1103 sales in 2019, Q3.

Following solid first quarter sales, real estate agents in the lower Hudson Valley region, served by OneKey™ Multiple Listing Service LLC, were prepared for an active second quarter. COVID-19 had other plans. The market came to an abrupt halt with real estate agents unable to show properties and confined to virtual interactions with buyers and sellers. Resiliency, creativity, and technology eased the shock and practitioners learned to navigate their new environment resulting in historically high single family residential third quarter sales figures.

Following solid first quarter sales, real estate agents in the lower Hudson Valley region, served by OneKey™ Multiple Listing Service LLC, were prepared for an active second quarter. COVID-19 had other plans. The market came to an abrupt halt with real estate agents unable to show properties and confined to virtual interactions with buyers and sellers. Resiliency, creativity, and technology eased the shock and practitioners learned to navigate their new environment resulting in historically high single family residential third quarter sales figures.

Optimism is strong.

Median sale prices of single-family homes were up in all counties including the Bronx despite a decrease in sales in that borough. Sullivan County had the highest percentage increase at 33.1 percent ($197,550 up from $148,450 in 2019).The median sale price in Westchester increased 15.9 percent to $810,000 from $699,00 (Q3, 2019), Orange County median was up 14.6 percent to $330,000 from $288,000 in the third quarter of 2019, Rockland up 7.4 percent to $510,000 (from $475,000) and Putnam up 9.7 percent to $411,250 from $375,000 in 2019.

Condominium sales were down in all counties with the exception of Putnam County where “condo” sales were up 28 percent to 50 units from 39 in third quarter, 2019. Ironically, condominium prices increased in all counties except Putnam.

Multi-family sales were down across the board leading to speculation that some of these decreases, both condo and multi-family, may be more a function of Covid-19 related issues than lack of buyers and/or interest. The weakness in the condo, coop and multi-family sectors took a toll on overall sales figures with Westchester County’s total residential sales down 1.3 percent to 2,949 units compared to 2,988 units in 2019, Q3 and Bronx sales down 29.6 percent.

Other counties having less significant condo and coop markets fared better in the quarter. Putnam county registered an overall increase of 8.6 percent total residential sales, Orange County up 4.6 percent, Rockland up 2.2 percent and Sullivan County with a virtually non-existent condo or coop inventory was still up 42.2 percent.

Lack of inventory continues to hamper sales in all residential categories.

Recently listing activity has increased as buyers become more comfortable with the measures in place to protect them from exposure to the Covid virus as well as the vibrancy of the market, according to HGAR (Hudson Gateway Association of Realtors. It is difficult to predict market conditions going forward.

In the short term, HGAR predicts the market remains strong with the number of properties in contract being exceptionally high at this point of the year. These contracts should represent closed sales before year’s end. Interest rates remain at historic lows which contributes to affordability. There is also the migration to the suburbs which is currently a factor and has created huge demand. What is difficult to evaluate however is how long a complete economic recovery will take and how that will impact the market going forward.