State Businesses Can Hold On To Sale Tax — May Be Eligible For Extension Or Waivers

If you run a New York business that collects sales tax, your quarterly return was due on March 20th. But you won’t face penalties or interest if you don’t make the payment.

Gov. Andrew Cuomo has offered relief in response to requests from many businesses — such as restaurants and bars — that have been closed this week due to the coronavirus outbreak.

Trade groups like the New York State Restaurant Association and the New York Farm Bureau had asked for the delay. Many operators of businesses that have shut or cut back their hours and staff have said they could use the sales money they’ve collected to help laid off workers. Many restaurants are providing food to go, but don’t need full staff to do that.

The sales tax, which businesses collect from their customers, will still be due eventually. The state sales tax is 4% of purchases, while county and local sales taxes vary from place to place.

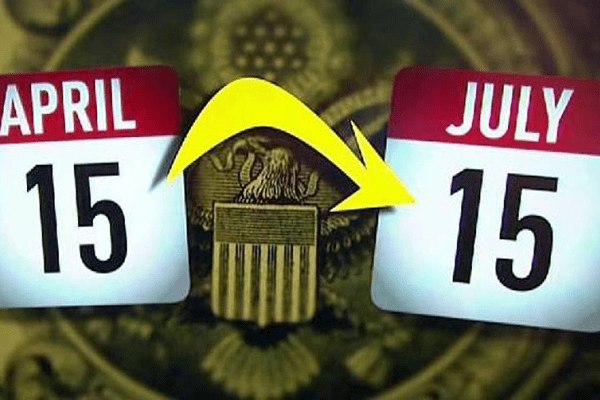

Tax Day Moved

On March 20, the Treasury Department moved Tax Day from April 15 to July 15.

Treasury Secretary Steven Mnuchin tweeted, “All taxpayers and businesses will have this additional time to file and make payments without interest or penalties.”

The payment deadline was extended but the filing deadline remained April 15, 2020. Now the filing deadline has been extended, too.

Mnuchin is encouraging businesses and individuals to file and pay on time if they can. “We encourage those Americans who can file their taxes to continue to file their taxes on April 15, because for many Americans, you will get tax refunds.”

On March 18, the IRS said individuals can defer up to $1 million of the tax due for 2019. This applies to all individual returns, including self-employed individuals and all entities other than C-corporations. For C-corporations, the extension applies to up to $10 million of the tax due. The relief applies also to the estimated tax payments for tax year 2020 that are due April 15, 2020.

Additional relief is on the way due to the enactment of the Families First Coronavirus Response Act (H.R. 6201), which President Trump signed into law on March 18. It includes:

- Emergency food and nutrition assistance

- Emergency paid sick days and leave days

- Emergency paid leave benefits

- Emergency unemployment insurance stabilization and access

- Full federal funding of extended unemployment compensation for a limited period

- Interest-free loans for states with advances

- Coverage of testing for COVID-19

Interest Rates Close To Zero

The Federal Reserve cut its benchmark interest rate to “close to zero” during a March 15, 2020, press conference call. It expects to maintain the rate at this level until confident the economy “has weathered recent events and is on track to achieve our maximum employment and price stability goals.” It’s also establishing a Commercial Paper Funding Facility (CPFF) to support the flow of credit to households and businesses, and encouraging banks to “use their resources to support households and businesses.”

State tax relief

States are being encouraged to follow IRS guidelines and delay their income tax due dates to July 15.

New York is among the states that have announced tax relief for businesses and individuals impacted by COVID-19. Relief may include filing extensions as well as interest and penalty waivers for a host of taxes, including lodging tax and sales and use tax. Gov. Cuomo says the NY income tax filing and payment deadline will match the IRS deadline.

What Cuomo Has Signed By Executive Order

Quarterly and annual sales tax filers unable to file or pay by March 20 due to COVID-19 may request a waiver from penalty and interest. This relief is not available for sales tax vendors who file returns monthly or participants in the Promptax program for sales and use tax or prepaid sales tax on fuel. Returns must be filed and the amount due must be paid within 60 days of the due date. Additional details.

New York City taxpayers may request a waiver of penalties on late-filed extensions or returns of business and excise taxes due March 16 – April 25. Interest must be paid on all tax payments due after the original due date.

To apply for this relief, select Request Relief below and complete the form as follows:

https://www.tax.ny.gov/press/alerts/sales-tax-relief-for-covid-19.htm Enter COVID-19 in the Subject line