By Michael Fidlow

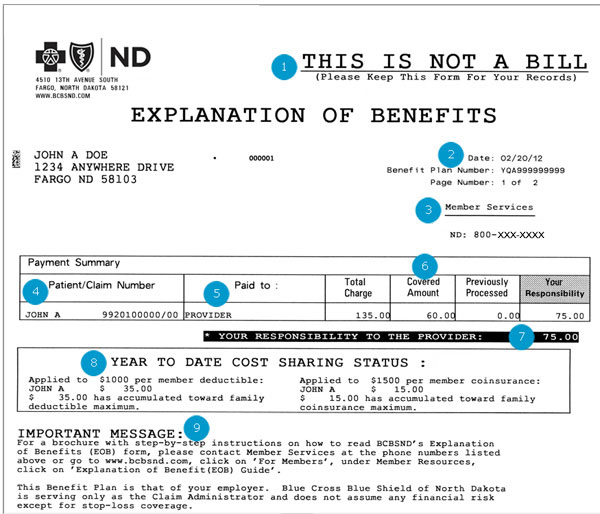

Mere mortals are not necessarily supposed to understand an “EOB” – Explanation of Benefits – the forms sent by medical providers. Trying to make sense of these forms that land in the mail box can actually make us feel queasy. Do not despair. Here is an easy guide to navigate these documents, and a few hints to make sure you are not exploited by medical providers.

Mere mortals are not necessarily supposed to understand an “EOB” – Explanation of Benefits – the forms sent by medical providers. Trying to make sense of these forms that land in the mail box can actually make us feel queasy. Do not despair. Here is an easy guide to navigate these documents, and a few hints to make sure you are not exploited by medical providers.

EOBs are very confusing. If not reviewed properly you may end up paying doctors and hospitals more than they are owed. In some cases, EOBs cause so much confusion that we shelve the payment and try to forget about it. The most important action one can take is to call your HR person, your carrier, or your broker. Let the experts do their job, and try to learn from their expertise. Never allow the EOB overwhelm you to the point your bills end up in arrears.

Terms on EOBs

Dates of Service: One day (doctor) or multiple days (hospital).

Procedure Code: AMA assigned service, current procedural technology code (CPT).

Service: This is a brief description of the CPT services performed during your visit.

Amount Charged by Provider: Retail cost your provider charges for the CPT service.

Discount Amount: Agreed upon charge by the provider for participating in the network.

Payable by Carrier: Amount carrier is stating they are responsible to pay provider.

Your Responsibility

Charges not Covered: The EOB will always provide a reason code*.

Deductible: Services that include a deductible before carrier participates in the payment.

Coinsurance: After deductible, the carrier and you will share in the remaining charges.

Copayment: The flat charge for many services provided by an in-network provider.

*Duplicate services, balance billing, services not covered under your medical plan, etc.

EOBs Explained

The most common types of claims are: In-Network Claims where a service is subject to a Copay. In-Network and/or Out of Network Claims where your service is subject to your Deductible and Co-Insurance. The following examples will reflect differently in the way the EOB is prepared.

When your plan allows you to see your Primary Doctor for a copay (without having to meet your deductible) the EOB will reflect the appropriate copayment cost and should be the only cost you are responsible for to the doctor. This cost is typically paid for at the time of your visit and will leave you with a zero balance upon receipt of the EOB from the carrier and the bill from the doctor.

When your service requires you to meet a deductible and co-insurance after utilizing an in-network provider, it is important that you focus on the costs you are responsible for. The provider will often send you their bill for the total retail cost. If the bill has not been paid by the carrier yet, that bill can be unnerving. No reason to panic. Wait for the EOB from the carrier as that will reflect the correct amount that you owe. Your responsibility comes directly from the Discounted Amount minus any of the Deductible and/or Coinsurance you may have met during the contract year.

The last example involves an out of network provider. In this scenario you will need to concentrate on the Charges Not Covered as that commonly reflects the balance bill. A balance bill is the amount the provider charges that is over and above what the reasonable and customary (R&C) amount the carrier is responsible to pay. This cost will be added to the deductible and coinsurance balance that you have remaining on your yearly claims to date. If you take the amount charged by provider minus the Charges Not Covered – that would let you know what the R&C is for that service. The most common R&C is based on a percentage of Medicare reimbursement levels.

Michael Fidlow is president of Strategic Employer Planning Group, LLC a group health benefits consulting firm for small companies in NY/NJ that employ 2-49 employees.