|

RCBJ-Audible (Listen For Free)

|

Palisades Center Seeking Four Years Of Tax Relief Against Clarkstown; Same Mall Owner Prevailed In Albany Court Securing Millions In Refunds And Future Reductions For Crossgates Mall

Eklecco/Pyramid, the owner of the Palisades Center in West Nyack, and the Town of Clarkstown, will face off in Rockland County Supreme Court later this month in a case that could severely impact both Clarkstown Central School District and Town of Clarkstown taxpayers. The Palisades Center is challenging four years of what it calls “illegal and inflated tax assessments.” If successful, it may be entitled to tens of millions of dollars in tax refunds, plus interest going back four years.

The Palisades Center, the largest taxpayer in Clarkstown, has over the past few years been weakened by online shopping, closures of anchors like Lord & Taylor, J C Penney, Bed Bath & Beyond and other big box stores, and from the COVID-19 shutdowns. Last February, Wilmington Trust, acting as a trustee for CMBS bondholders, filed in New York Supreme Court, New York County, to foreclose on the 2.2 million-square-foot shopping and entertainment complex, claiming Syracuse-based owner Pyramid Management Group defaulted on a $418.5 million loan tied to the mall property. There has no activity on the case since July.

From 2020 to 2023, Pyramid has filed tax certiorari cases in Rockland County Supreme Court after Clarkstown rejected its tax assessment challenges. The four cases have been consolidated and are set for trial Feb. 26th before Rockland County Supreme Court Justice Amy Puerto who will decide on the assessed values, the fair market values, and potential refunds.

Partly at issue for years 2022 and 2023 is whether the mall has had a comeback: Pyramid in the lawsuit claims the mall has not recovered, especially since the pandemic, while the town asserts that the mall’s net income is comparable to pre-pandemic levels and that its value continues to rise.

The two parties are hundreds of millions of dollars apart in the determination of the mall’s fair market value. If the mall prevails in court, 60 percent would have to be paid by the Clarkstown School District. The balance would be owed by the town and county.

Both parties agree the valuation should be determined through a method called “capitalization,” which is multiplying the net income earned from the property by a capitalization rate to determine a fair market value. Capitalization rates are economic multipliers determined by a number of factors including interest rates, values of similar properties, and future risks and economic trends.

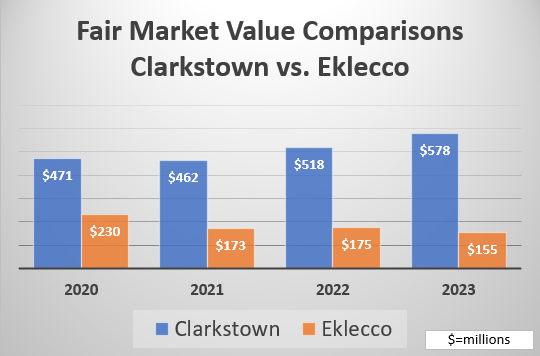

For calendar year 2020, the town assessed the mall at $140 million based on its determination that the fair market value (FMV) of the property was $471 million. An equalization rate is applied to the FMV to determine the assessed value. Taxes are based on assessed value, not FMV. Eklecco claimed FMV in 2020 was $230 million, less than half of what the town maintained.

For the next three calendar years, the town continued to assess the mall at $140 million based on its determination that FMV was $462 million (2021), $518 million (2022) and $578 million (2023). Eklecco lawsuit claims FMV was $173 million in 2021, $175 million in 2022 and $155 million in 2023.

For years 2020 and 2021, Eklecco is seeking a refund in excess of $20 million, according to filings in the court. However, years 2022 and 2023 are in dispute but if the mall prevails, the total refund for the four years could climb as high as $40 million.

There may be striking similarities between the lawsuit in Albany County with the one here in Rockland County.

Pyramid, which owns the Crossgates Mall in Albany County in the Town of Guilderland, prevailed in its tax certiorari case in December when the court ordered the 2019 tax assessment to be reduced by $24 million from $282 million to $258 million. For 2020, the court ordered an additional $81 million reduction to $177 million.

Despite the ruling in favor of Pyramid in Albany, both sides filed appeals of the lower court’s decision. Pyramid still has outstanding challenges in Albany against the Town of Guilderland for years 2022 and 2023. New York law does not allow an assessment to be disturbed in the three years following a successful tax challenge and Pyramid has sought refunds from the local taxing authorities for those years.

Crossgates is a 1.7 million square-foot indoor “super-regional” shopping mall — the largest in the Capital District and the fifth largest in the State of New York.

Pyramid’s lawyers in Guilderland argued the mall once valued at $400 million dollars 20 years ago is now worth about $100 million. This is the same argument Pyramid is making about the Palisades Center while it faces more than $400 million in debt. Clarkstown acknowledged a dip in net income for the mall in 2020, which would affect its assessment in 2020 but claims income and valuation have rebounded in 2021 through 2023. Eklecco disputes the rebound. It has submitted documentation to the court showing lease renewals with extensive rent reductions for existing and new tenants signed in 2020-2022, and net income far below what the town detailed.

Similarly, at Crossgates, dozens of stores left at the onset of the pandemic. Others sought rent reductions and concessions to remain. The fall in leasing income led Pyramid/Eklecco to default on a $300 million loan collateralized by the real estate at Crossgates.

In 2021, the Palisades Center lost a lawsuit against the town based on its claim that it overpaid taxes in 2008, 2009, 2012 and 2013. That suit was not based on illegal assessment, but on what the mall called an “ambiguity” in an earlier tax settlement that it said capped its taxes at $21 million per year. The mall’s claim that it overpaid by $2.64 million in those tax years was rejected by the court.

In the tax assessment case, the Town of Clarkstown is represented by John Flannery of Wilson Elser, White Plains. Eklecco is represented by Craig Leslie of Phillips Lytle, Buffalo, NY.