|

RCBJ-Audible (Listen For Free)

|

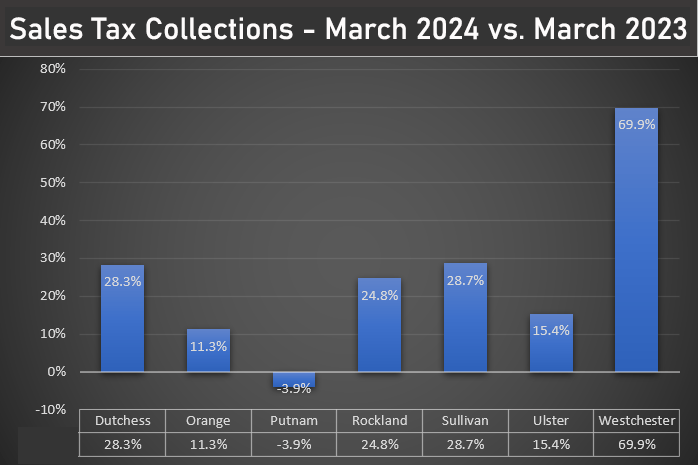

Year-Over-Year Data Shows Sales Tax Collections Up After Early Downward Trend; March Collections Up Almost 35% Region-Wide

DATA ANALYSIS

Rockland County saw a major boost in sales tax collections in March, turning what looked like a downward trend in collections back into the black, based on data released by the Office of the State Comptroller. Sales tax collections in March of 2024 were almost 25 percent higher than collections a year ago in March of 2023. Collections this March were $26.39 million, compared with only $21.15 million last March.

Rockland County was not the only county in the Mid-Hudson Region to see a major boost in sales tax collections in March. Westchester County’s collections year-over-year were up almost 70 percent, Sullivan and Dutchess both enjoyed a major boost, up 28.9 percent and 38.2 percent, respectively. In fact, collections for the region were up nearly 35 percent in total. The only county that saw a decrease was Putman, with collections down 3.9 percent.

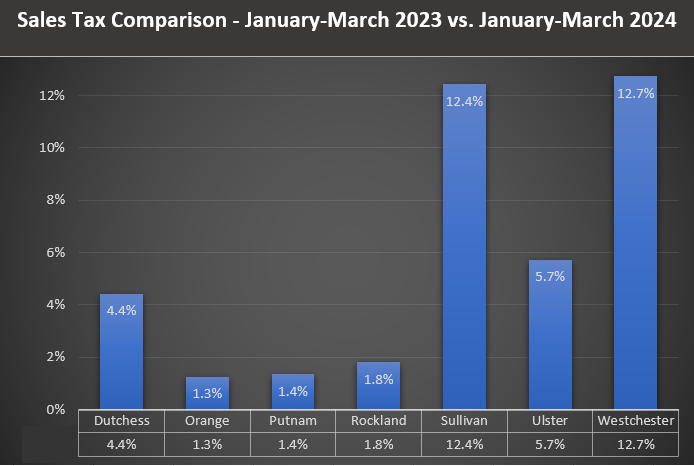

Data published by Thomas DiNapoli’s Office of the State Comptroller had shown a downward trend for January and February of 2024 for Rockland County. January’s year-over-year comparison showed a decline of 9.5 percent. February’s year-over-year decline was 7.7 percent. But the major boost in March pushed the quarterly numbers back in the black with a 1.8 percent increase over the same quarter in 2023.

The report also showed Westchester and Sullivan Counties’ collections up 12.7 percent and 12.4 percent, respectively, and as what might be a show of economic strength in the region, every county in the Mid-Hudson Region had a quarterly year-over year increase, with the region-wide increase at 6.7 percent.

A spokesperson for Rockland County speculated that the reason for the increase could be attributed to inflation and high gas prices. The County attributed previous dips in sales tax collections to the elimination of the residential energy sales tax, which provided $12 million in revenue annually.

According to a spokesperson from the Comptroller’s Office, it is not uncommon to see “some volatility in monthly year-over-year growth in sales tax distributions within a single calendar quarter, especially during reconciliation months (March, June, September, December).”

“However, over the past few years, COVID has had a compounding and dramatic effect on monthly year-over-year growth. What happened to most counties in the Mid-Hudson, as well as several in other regions, we believe is more related to COVID’s long-term effect on monthly year-over-year changes in sales tax distributions.”

Sales tax in Rockland County is 8.375 percent of taxable items like clothing, appliances and cars. Of that, 4 percent is the state’s share, and .375 percent goes to the MTA. The other 4 percent, collected by the county, is shared with Rockland’s towns and villages.

Sales tax allocations are made in accordance with sharing agreements between the counties and their cities, towns, and villages. Sales tax sharing agreements are required when county sales taxes are allocated on a basis other than population. All sales tax sharing agreements must also be approved by the state comptroller.

Shortfalls in county sales tax revenue pass through to the towns as the towns share a percentage of collected revenue. Rockland County shares only about 6% of collected revenues with the towns and villages.

Towns and villages depend on that revenue when preparing their fiscal year budgets. Clarkstown budgeted $5.3 million in revenue from its share of 2024 county sales tax. Ramapo budgeted $2.4 million, Orangetown $2.1 million; Stony Point $800,000; Town of Haverstraw $700,00, Village of Haverstraw $320,000.

The Office of the State Comptroller releases sales tax collection data by County and Region every month.