|

RCBJ-Audible (Listen For Free)

|

Auditors Conclude District Under-Estimated Revenue, Over-Estimated Expenses, Maintained Excessive Fund Balances

The Office of the State Comptroller recently completed an audit of the North Rockland Central School District’s finances revealing a host of problems in management, budgeting and planning. The school district records from July of 2019 through June of 2024 were audited to enable the Comptroller to study trends, rather than isolated incidences.

In a nutshell, the audit found that school board and district officials did not adopt and develop realistic budgets because they overestimated appropriations and underestimated revenues, resulting in excessive fund balances that could have been used to reduce taxes.

The audit also found the school board did not effectively manage the district’s fund balances properly; that reserves were not always funded as part of the budget process or lacked proper management; that the school board did not develop a written multiyear financial plan; and that no comprehensive capital plan was developed to address capital needs.

The audit report includes eight recommendations that, if implemented, would improve the district’s financial management. District officials disagreed with some of the Comptroller’s findings but are still required to take corrective action via a written Corrective Action Plan (CAP). The CAP is due in early March 2026 and implementation of the CAP must begin by the end of the next fiscal year.

Fund Balances & Budgets

Specifically, the audit asked: Did the Haverstraw-Stony Point Central School District Board of Education and officials effectively manage the district’s financial condition?

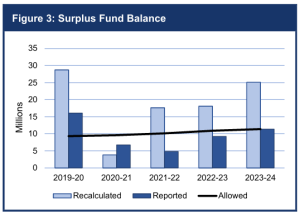

School districts maintain fund balances, essentially representing the difference between revenues and expenditures accumulated over time. Under state law, school districts are allowed to retain a portion of surplus fund balances, up to 4 percent of the budget, for unexpected occurrences and fluctuations in cash flow. Any surplus fund balance exceeding the 4 percent must be applied to reduce the upcoming year’s real property tax levy or appropriately fund other needed reserves.

Budgeting requires sound estimates and well-supported budgetary assumptions based on historical data or known trends. Multiyear financial plans help guide officials to develop future budgets and provides more transparency regarding the district’s long-term financial goals.

The audit found the district regularly overestimated its expenses in its budgets and underestimated its revenues, created annual operating surpluses, resulting in the accumulation of significant fund balances. Despite the consistent surpluses, the Board indicated to taxpayers that it needed to appropriate fund balances to balance its operating budgets.

The audit also revealed the district’s use of transfers skewed an accurate picture of its permitted fund balance. Auditors recalculated the fund balances and found that the district maintained a larger fund balance than permitted by state law, at times more than three times the amount permitted by law.

The audit recommended that the district establish a written policy defining the amounts of fund balance that the district should reasonably maintain and plan to reduce its surplus fund balance to comply with the statutory limit. Surplus funds can be used for reducing district property taxes, funding one-time expenditures, funding needed reserves, or paying off debt.

Other financial issues are detailed in the report, including an excessive reserve to pay unemployment claims (the fund balance would cover 72 years of average unemployment claims); excessive reserves for settling tax certiorari claims (reserves were held at six times the amount needed to settle claims); and excessive reserves for contributions for state and local retirement contributions (up to five times the necessary amount).

The audit also concluded that the Board did not develop a written multiyear financial and a comprehensive capital plan to help guide officials as they develop future budgets.

District officials responded that three years of COVD complicated financing, especially as related to monies received from the state and federal governments. The district also said that budgets have to consider contingencies that are not always apparent at the time the budgets were developed and passed.

Auditors acknowledged the budgeting challenges faced by school districts during the global COVID-19 pandemic, but affirmed that state law only allows school districts to retain up to 4 percent of the budget as a surplus fund balance, for unexpected occurrences.

The Comptroller’s auditors concluded that the board and district officials did not adopt and develop realistic budgets because they overestimated appropriations and underestimated revenues. With unbudgeted transfers of operating surpluses to reserves and the capital projects fund, the Board and District officials overestimated appropriations by a total of $118.2 million, money that could have been used for other purposes including reducing the annual burden on taxpayers.

He continued: “At the same time, NRCSD worked aggressively to control costs by negotiating fair pricing, completing projects in-house when appropriate and avoiding the common and counterproductive practice of spending down funds at the end of the fiscal year simply to avoid exceeding the 4% fund balance limit. Instead, the District made the prudent decision to establish a voter-approved capital reserve, allowing it to use public funds transparently and thoughtfully.”

RCBJ reached out to the spokesperson for the North Rockland Central School District by email, phone and text, but did not get an immediate response.