|

RCBJ-Audible (Listen For Free)

|

Rockland County Has The Highest Market Rents For Two-Bedroom Apartments In The Region And Declining Average Wages in 2024

An annual report prepared by the Hudson Valley Pattern for Progress and its Center for Housing Solutions & Community Initiatives validates what we all know: there is a housing crisis in the Hudson Valley, and here in Rockland County, of both housing affordability and availability. Derived from data published annually by the National Low Income Housing Coalition, the report describes the growing gap between earnings and housing costs, and how real wages dipped in 2024 while rents and home prices continue to increase.

The crisis is very real and presented in extreme detail in the report titled, “Out of Reach.” According to the report, a single truth is emerging: “the future of the Hudson Valley, the vibrancy of our communities, the viability of our small businesses, and the health of our institutions will be determined by how our civic leaders collaborate to tackle the affordability crisis.”

The report looks at the average hourly wages, based on data reported by the Bureau of Labor Statistics (BLS) and on Fair Market Rents, which are calculated by the Department of Housing and Urban Development (HUD) based on selection of renters who have secured apartments in the last two years in each area. The “rent gap” is the difference between the fair market rent costs and rents that “would be affordable to an average renter, earning an average income working 40 hours per week in a full-time job.”

The “purchase gap” looks at the level of affordability for middle-income households looking to buy a home, and is the difference between “the estimated mortgages for which households at 100% the average median income would qualify for versus the actual mortgage necessary to buy a median-priced home in the county.

For Rockland County, the picture is bleak.

From 2019 through 2023, the average hourly wage for renters in Rockland County increased every year from 2019 through 2023 (2019, $10.98 | 2020, $11.53 | 2021, $12.14 | 2022, $14.76 | and 2023, $15.91). In 2024, the average hourly wage slipped 3%, down to $15.47 per hour. Looking at inflation adjusted wages though, 2024’s wage is really only worth $13.47 in 2019 dollars, about a 15% increase in real wages.

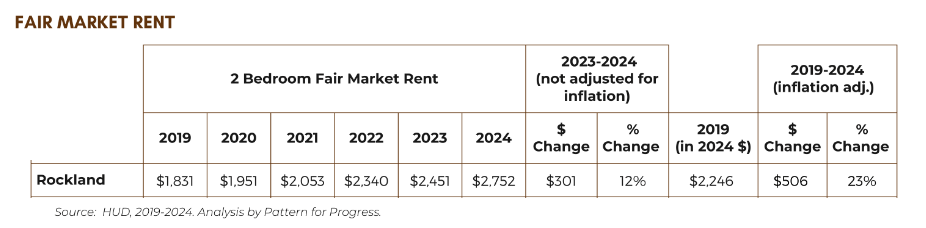

At the same time, the fair market rents in Rockland County have increased from $1,831 in 2019 to $2,752 in 2024, an increase of over 50%, or 23% in inflation adjusted dollars. Of the nine counties studied in the report, Rockland County had the highest 2-bedroom fair market rent, tied with Putman County — $400 per month more than Westchester County.

Based on these figures, the average Rockland wage earner would need to earn $52.92 per hour (a gap of $37.45 per hour) to comfortably afford a two-bedroom apartment in Rockland County. “Comfortably” is considered a worker spending no more than 30% of their income on housing costs. To earn that amount, a single worker would have to work 137 hours per week at the average wage. The report says that based on prevailing wages, the average single worker could afford only $804 per month in rent before being rent burdened.

The analysis also looks at two-income households, where the average two income household earns $64,353, but to comfortably afford a two-bedroom apartment in Rockland, those renters would need to earn $110,080 per year, according to the report.

The future looks as bleak when it comes to home ownership, where the report looks at the “mortgage gap” or the “purchase gap” defined as the “the difference between estimated mortgages for which households at 100% AMI (average median income) would qualify and the actual mortgage necessary to buy a median-priced home in each county.

For those looking to buy a home for that same two-earner couple, the AMI for Rockland County is $106,720, which would qualify a couple for a mortgage of $288,290, while the median price of a home in Rockland County in 2023 was $605,000. Putting 6% down, the two-income couple would still come up over $280,000 short if they sought to purchase a median priced house.

The report also notes that the incomes of residents moving to Rockland County is lower than the income of persons who are leaving the county, which brings down average incomes, while at the same time, rents and home prices continue to grow.

The report makes the case, analytically, for changes in the supply of housing, more modern and flexible zoning, allowing different types and sizes of housing to meet demand, more affordability mandates, tools to reduce the high costs of land and taxes, and balanced tenant protections.

Despite the data, towns and villages in Rockland County largely reject the idea of expanding housing opportunities. Instead, they fight to “preserve the suburban ideal” with single-family neighborhoods and restrictive zoning. Statewide efforts to mandate more housing have met steadfast opposition in most of Rockland County.

The report asks regional leaders to “welcome and encourage more housing, rather than opposing and protesting it.” It says we “must be open-minded about different kinds of housing. including co-ops. mobile homes. smaller homes on smaller lots, and housing that utilizes new building technologies. Our land-use boards must commit to a process that is rational. predictable. and relatively quick. all while protecting human and environmental health.”

Pattern For Progress has been producing annual wage and housing data reports in the Hudson Valley for more than a decade.