|

RCBJ-Audible (Listen For Free)

|

Kingston Local Development Corporation Offers Façade Loans, Revolving Loans, and Microbusiness Financing

Municipalities utilize Local Development Corporations (LDCs) to foster economic development. Established as non-profits, separate and distinct from the local government, LDCs provide vital resources to local businesses. The non-profit boards are largely made up of local elected officials, along with municipal employees and members of the private sector.

In Kingston, the LDC (KLDC) offers several loan programs with competitive rates and no pre-payment penalties designed to support business owners within the City of Kingston.

In Kingston, the LDC (KLDC) offers several loan programs with competitive rates and no pre-payment penalties designed to support business owners within the City of Kingston.

The KLDC offers a Façade Loan Program to assist commercial property and business owners with exterior building improvements that enhance the visual appeal and vitality of commercial corridors. The program now offers loan amounts of up to $35,000, with competitive fixed interest rates and flexible repayment terms.

The KLDC also administers a Revolving Loan Fund (RLF) to help established businesses secure additional financing for projects such as expansion, acquisition, renovations, or other growth-related needs. The RLF works with traditional financial institutions to help businesses move forward when a financing gap exists. Low–interest “gap” loans (up to 25% of the total project cost) are available to businesses that have secured partial financing through a bank as well as their own monies.

For newer or smaller businesses, the KLDC also offers a Microbusiness Loan Program, intended to support early-stage enterprises and entrepreneurs who are just getting started. This program offers competitive fixed interest rates and flexible repayment terms. The Microbusiness Loan Program provides low interest loans of up to $7,500 for small business entrepreneurs.

To date, the KLDC has supported 145 businesses, approved 156 loans, and distributed over $10 million to local businesses.

KLDC President Steve Noble said, “The Kingston Local Development Corporation is thrilled to offer these financing tools for local business, which can do everything from help strengthen existing businesses, encourage expansion, and support new entrepreneurial activity, all with extremely competitive rates.”

“These loan programs are an important part of our mission to promote economic development and support local businesses,” said Amanda Bruck, KLDC Executive Director. “We encourage business owners to explore these resources and see how they may help advance their businesses or projects.”

Business owners located within the City of Kingston who are interested in learning more about available loan programs, eligibility requirements, and the application process are encouraged to contact the Kingston Local Development Corporation at 845-334-3930 or visit www.KLDC-ny.org.

Newburgh Receives North America’s Most Prestigious Award for Financial Reporting and Transparency

The City of Newburgh has been recognized for excellence in financial stewardship, earning the Certificate of Achievement for Excellence in Financial Reporting, North America’s highest honor for state and local government financial reporting, awarded by the Government Finance Officers Association (GFOA).

The City of Newburgh has been recognized for excellence in financial stewardship, earning the Certificate of Achievement for Excellence in Financial Reporting, North America’s highest honor for state and local government financial reporting, awarded by the Government Finance Officers Association (GFOA).

The GFOA award is considered the highest form of recognition in governmental accounting and financial reporting.

The GFOA is a non-profit professional association for state, provincial, and local government finance officials in the U.S. and Canada, dedicated to improving public finance through resources, training, best practices, and networking to enhance transparency, accountability, and financial management in government operations.

This marks the fourth consecutive year Newburgh has received the award. It is the only municipality in Orange County and one of only six cities in New York State to receive the distinction.

“This recognition reflects years of disciplined management, clear priorities, and an unwavering commitment to transparency,” said City Manager Todd Venning. “When I arrived in Newburgh, the City was facing deep structural and credibility challenges. Together, my team rebuilt the City’s financial operations from the ground up—strengthening internal controls, restoring trust with oversight agencies, and proving that with professional, nonpolitical management, Newburgh is capable of stewarding its resources responsibly and strategically.”

In October 2025, the New York State Office of the State Comptroller issued its top fiscal health score to the City of Newburgh for the sixth consecutive year, making Newburgh the only city in New York State to achieve that distinction. The Comptroller’s report cited a 36 percent year-over-year increase in home values and a 72 percent decline in unemployment, highlighting the City’s strong long-term fiscal outlook.

That assessment was echoed by Moody’s Investors Service, which upgraded the City’s credit rating to A1 from A3, citing Newburgh’s strengthened governance framework, professional management team, and improved financial controls.

In July 2025, Newburgh received the GFOA’s Distinguished Budget Presentation Award for the third consecutive year, recognizing the City’s budget as meeting the highest international standards as a financial plan, policy document, operational guide, and communications tool.

“This level of financial performance is no longer exceptional for Newburgh—it is the standard,” said Mayor Torrance Harvey. “Stability is what turns plans into progress. That stability is what allows Newburgh to advance major projects, attract new investment, and maintain the strong financial footing our residents have come to expect from our executive leadership team.”

Conservation Easement Offers Permanent Protection To 108 Acres in Shawangunk Ridge

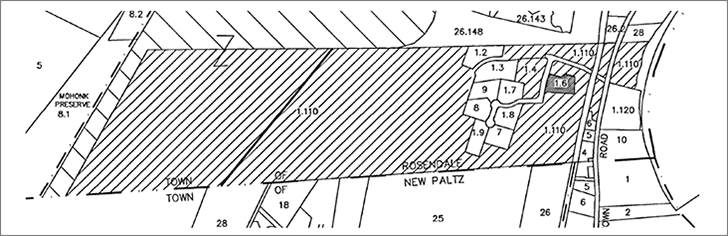

A conservation easement on 108 acres of land on New York’s Shawangunk Ridge will offer permanent protection and add to the Wallkill Valley Land Trust’s (WVLT) 3,000 acres of protected land.

A conservation easement is a voluntary, legal agreement between a landowner and a land trust (or government agency) that permanently protects land from development. While the landowner retains ownership, the future use of the land is restricted by the terms of the easement—such as a ban against subdivision or commercial construction—to conserve natural resources, wildlife habitat, or scenic, agricultural, and historic values.

The conservation easement was secured in December of 2025, according to an recent announcement by the WVLT.

The easement ensures that a critical section of the Shawangunk Ridge—and the views, habitats, and trail corridors it supports—will remain protected forever. The property sits on the border between the towns of New Paltz and Rosendale and is surrounded by land owned by the Mohonk Preserve. Existing houses are clustered together with expansion restricted.

“This project demonstrates what is possible when private landowners, conservation organizations, and community supporters share a long-term vision,” said Christie DeBoer, Executive Director of Wallkill Valley Land Trust. “We are honored to hold this easement and to help ensure that these lands remain wild, scenic, and cared for in perpetuity.”

The easement establishes multiple “use areas,” ranging from highly restrictive forest conservation zones—covering the majority of the acreage—to limited reserved rights near the existing homes. These include a managed pond, an open field that provides important wildlife habitat, and limited agricultural use near the residential cluster. The Wallkill Valley Rail Trail also passes through the eastern portion of the protected land and is further safeguarded by this easement.