|

RCBJ-Audible (Listen For Free)

|

Clarkstown Planning Board Advances Religious School On West Clarkstown Road With Negative SEQRA Declaration And Preliminary Site Plan Approval

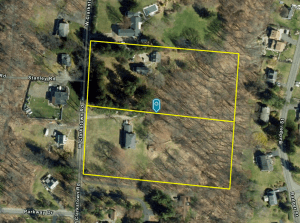

After more than five years of heated public meetings before the Clarkstown Planning Board, the board last week issued a negative declaration under SEQRA (State Environmental Quality Review Act) and preliminary site plan approval for the demolition of two existing single family homes and for the construction of a 37,495 square foot private, religious school on 6.6 acres of R-40 zoned land on the east side of West Clarkstown Road just south of New Hempstead Road.

After more than five years of heated public meetings before the Clarkstown Planning Board, the board last week issued a negative declaration under SEQRA (State Environmental Quality Review Act) and preliminary site plan approval for the demolition of two existing single family homes and for the construction of a 37,495 square foot private, religious school on 6.6 acres of R-40 zoned land on the east side of West Clarkstown Road just south of New Hempstead Road.

Residents had been packing planning board meetings, charging that the road was being unfairly utilized for large scale projects because Clarkstown’s zoning code protected town and local roads from most non-residential development. Large projects gravitate toward county roads, like West Clarkstown Road, despite its extensive accident history, winding turns, existing traffic burdens, and lack of maintenance. The school downsized its plans in response to community opposition.

The religious school at 31 West Clarkstown Road received unanimous approval and moves on to the town’s architectural review board (AHRB) for aesthetic consideration. No zoning variances are required.

Residents have opposed a number of projects on the road, including plans to demolish the former Camp Champion and construct a 146,880 square foot, three-story senior housing complex with 123 apartment units and 217 parking spaces on 9.18 acres of R-22 zoned land on the east side of West Clarkstown Road. That project also received a negative SEQRA declaration from the Clarkstown planning board and is before the AHRB.

A negative SEQRA declaration means that the planning board determined that the project will not have a significant impact on the environment and that no detailed environmental review is necessary. The negative declaration deprives the public of participation in scoping and reviewing the project’s potential environmental impacts.

Torn Ranch Seeks Zoning Text Amendment; It Is Operating Under Former Owner’s “Retreat” Use, Precluding Expansion Or Alteration

TR-HV LLC, also knows as Torn Ranch, the purchaser of the 146 acre religious retreat formerly owned by the Sister Servants of Mary Immaculate in the Town of Ramapo, has asked the Town Board to amend its zoning code to create a “Health & Wellness Retreat” use category in the town’s RR-80 and 160 zones.

TR-HV LLC, also knows as Torn Ranch, the purchaser of the 146 acre religious retreat formerly owned by the Sister Servants of Mary Immaculate in the Town of Ramapo, has asked the Town Board to amend its zoning code to create a “Health & Wellness Retreat” use category in the town’s RR-80 and 160 zones.

The property was historically known as the Table Rock Estate and was used as a religious retreat from 1941 until its purchase by Torn Ranch. Its certificate of occupancy allows for a “retreat” use, and the building inspector determined that Torn Ranch can operate its high-end spa there as an approved continuation of a “retreat,” a pre-existing non-conforming use under the town’s zoning law.

Torn Ranch renovated the house, preserving its most significant historical and architectural features and began operating as a health and wellness retreat in the Spring of 2024. However, because its use is pre-existing, non-conforming, it is prohibited from expanding, or altering the structures or changing its use.

Torn Ranch had sought a zoning use variance to permit construction and operation of a second swimming pool, and would need other variances for a construction and installation of a greenhouse, tennis court, or guest cottage, according to a petition it filed with the Town to create a new “Health & Wellness Retreat” use.

The town previously amended its zoning code in the RR-80 zone and created the use category of “Country Inn” to accommodate Torne Brook Farm allowing the new owner to operate a vineyard, inn, restaurant, and catering facility on the existing Victorian Gothic mansion built by industrialist Charles Pierson.

Health and Wellness Retreats would be defined as “an estate-type residential structure which had in the past served as a single-family residence, and any additions thereto,” in which the following uses are permitted:

- Residential accommodations for enrollees at on-site health and wellness training programs, and corporate retreats, and for faculty and staff;

- Restaurant and/or dining facility primarily serving enrollees; and

- Facilities for exercise, training, yoga, meditation, spa, swimming, classes and lectures, group discussions, meetings and similar activities.

The new use would only apply to properties larger than 100 acres.

Accessory to the use would allow:

- swimming pools, solarium, tennis courts and other sport courts, hiking trails, boathouse, and similar structures for the use of persons staying at the retreat.

- greenhouses, gardens and agricultural operations permitted in the District provided produce is primarily for “farm to table” use on the premises.

- garages, sheds, barns, seasonal event tents, laundry and similar structures servicing the retreat.

- cottages or other residential structures for use by enrollees or faculty and staff with a culutative gross floor area not to exceed 175% of the gross floor area of the principal building.

- maintenance and utility shops for the upkeep and repair of buildings and structures on the site and the grounds.

Next steps would include issuance of a negative SEQRA declaration on the proposed zoning amendment and a referral to the Rockland County Department of Planning for GML review.

New York Boulders’ 10-Year Lease Extension Will Add Artificial Turf, Additional Revenue, and Decreased Expenses

The New York Boulders lease Clover Stadium from the Ramapo Local Development Corporation (RLDC) under a twenty-year agreement that expires in 2031. The Boulders, seeking a ten-year extension of that lease, have agreed to fund a $1.2 million interest free, ten-year loan to the RLDC to install artificial turf at the stadium. The stadium currently has a natural turf field.

The New York Boulders lease Clover Stadium from the Ramapo Local Development Corporation (RLDC) under a twenty-year agreement that expires in 2031. The Boulders, seeking a ten-year extension of that lease, have agreed to fund a $1.2 million interest free, ten-year loan to the RLDC to install artificial turf at the stadium. The stadium currently has a natural turf field.

The RLDC says the conversion to turf will have significant benefits, including the elimination of expenses related to mowing, watering, fertilizing and pest control. It also will allow the field to be used in all weather conditions and provide an extension of the playable season.

According to the RLDC, the Boulders have also agreed to increase the fixed portion of the annual rent from $175,000 per year to $225,000 during the extended period. Part of the agreement also includes the Boulders sharing 60 percent of the field rental revenue it receives from the Metro Atlantic Athletic Conference baseball tournament with the RLDC.

It is expected that the revenue sharing arrangement will provide the RLDC with an additional $25,000 per year.

The RLDC also earns revenue from a share of ticket sales ($1 per ticket sold); a share of parking fees ($2 per car parked); a share of net merchandise sales (20 percent of game day sales); a share of net food and beverage sales (10 percent); a share of naming rights revenue (50 percent) and a share of net suite rentals (50 percent).

The RLDC pays for utilities, and some cleaning and maintenance expenses.