|

RCBJ-Audible (Listen For Free)

|

In An Annual Ritual, Owners Of Commercial And Residential Properties Seek Reductions In Property Valuations & Taxes

Benjamin Franklin said, “In this world nothing can be said to be certain, except death and taxes.” He was probably right about death, but in New York, taxes, especially property taxes, are a bit less certain.

New York has set up two paths for property owners to challenge the assessed values on their properties. A reduction in an assessed value leads to a reduction of taxes.

The first is largely limited to homeowners. A procedure called SCAR (Small Claims Assessment Review) provides an informal review of an assessment through the courts after a homeowner’s efforts with the local taxing authority fail. Thousands of these petitions are filed in Rockland County Supreme Court every year. In July, over 2,200 SCAR petitions were filed by aggrieved homeowners by an industry set up to earn a share of any reduction in tax liability. By statute, there are limits to the amount of the reduction a homeowner can achieve. For most Rockland properties, a SCAR petition can yield a maximum reduction of 25 percent of the property’s assessed value.

But, the real meat and potatoes of property tax reduction is on commercial properties, where Rockland property owners, large and small, file petitions in tax certiorari cases in which they claim the real estate tax assessment placed on their property by municipalities are excessive or illegal. These cases, filed by the hundreds every year, allows owners to say the assessments and valuations are inaccurate or unfairly high. Again, a reduction in the assessment leads to a reduction in the real estate taxes owed.

Common grounds for challenging an assessment include:

-

- Excessive Assessment: The property’s assessment exceeds its fair market value.

- Unequal Assessment: The property is assessed at a higher percentage of its fair market value than comparable properties in the same area.

- Unlawful Assessment: The property is wholly exempt, or there are other legal issues with the assessment.

- Errors in Assessment: The assessment is based on inaccurate information (e.g., incorrect square footage or lot size) or fails to account for depreciation or other factors affecting the property’s value.

There are likely countless cases of inaccurate or unfair assessments, but a closer look at some of the cases filed leans toward owners seeking outrageous reductions, claiming their properties are really worth as little as 10 percent of their market values.

For example, the Harbors At Haverstraw filed a petition with the Court claiming the valuation Haverstraw place on its property of over $28.4 million on the hundred or so addresses making up its development actually have a market value of about $9.9 million (about 34 percent of its valuation), alleging its property is over-valued by $18.5 million.

Another example. The Diana Place apartment on Main Street in Nyack is claiming the valuation Orangetown placed on its property of $1,582,820 was misclassified, excessive and illegal and that the actual value of the property is more likely only $158,280 (10% of its valuation), alleging an over-valuation of $1,424,520.

FB Orangetown, the owner of the hotel and retail complex on Stevens Way in Orangeburg filed its petition seeking a 90 percent reduction in value, from just over $8 million, down to $800,000, claiming an over-valuation of $7.2 million.

And, GBR Valley Cottage, the owner of the shopping center housing the Foodtown Supermarket is also seeking a 90 percent reduction in the value of the parcels in its center from $2.437,500, down to $243,750.

These are just a few of the examples of tax certiorari cases filed in Rockland County that the towns have to defend. Few ever go to trial, most property owners hope they can negotiate some sort of reduction in a settlement. Some file to preserve their rights to a reduction, because a failure to contest a valuation is the same as a waiving a dispute.

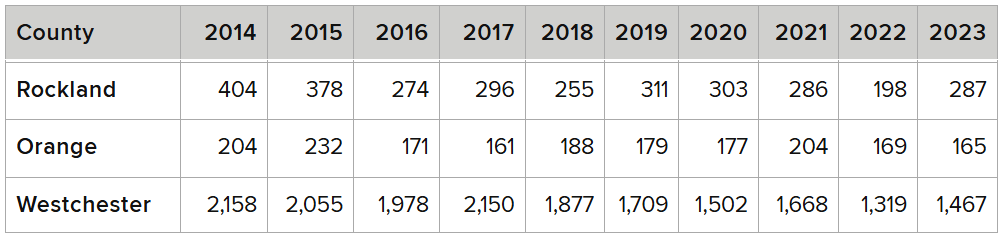

To get a sense of the magnitude of the filings, in Rockland County alone, almost 3,000 tax certiorari cases were filed between 2014 and 2023. In Orange County, 1850 cases were filed in the same period. And, in Westchester, almost 18,000 cases were filed.

While many property owners make outrageous claims regarding valuation, the filing of a petition in court is the only way to achieve a reduction when a municipality won’t budge or isn’t acting in good faith.

Some petitions yield small reductions or concessions, and others yield major settlements, sometimes in the millions of dollars. Last year Clarkstown settled several years of tax certiorari cases with the Palisades Center and had to reimburse the owner $27.5 million (of which the Clarkstown School District was responsible for about $18 million). Similarly, Clarkstown settled with the owners of the Shops At Nanuet at a cost to the Town of about $500,000, according to a resolution passed by the Town Board in July of 2024. Clarkstown approved a bond of $8.7 million to finance the refunds. Smaller settlements and refunds are often on the agenda at town board meetings across the county.