|

RCBJ-Audible (Listen For Free)

|

A Presentation At A Recent RBA Luncheon Offered Mostly Good News, Tempered by Uncertainty And Mixed Consumer Sentiment

Kartik Athreya, Director of Research and Head of the Research and Statistics Group for the Federal Reserve Bank of New York, last week delivered a presentation at the Rockland Business Association’s General Membership Luncheon on the state of the economy, both nationally and regionally.

Athreya’s talk covered areas including growth, noting that real GDP (gross domestic product) shrunk at a .3 percent annual rate in the first quarter of 2025. He also spoke about softening in the labor market, inflation still hovering above the Fed’s target, and how uncertainty remains elevated.

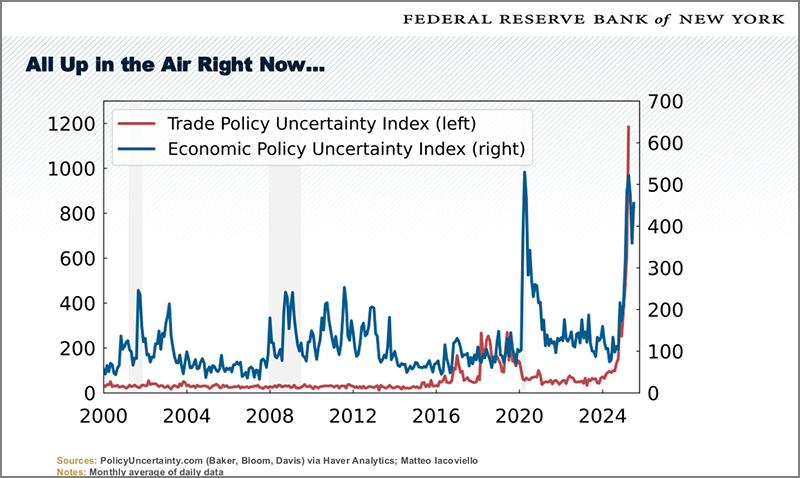

Athreya used two indexes the Fed relies on to measure uncertainty: the Trade Policy Uncertainty Index (TPUI); and the Economic Policy Uncertainty Index (EPUI), both of which were at or near all-time highs.

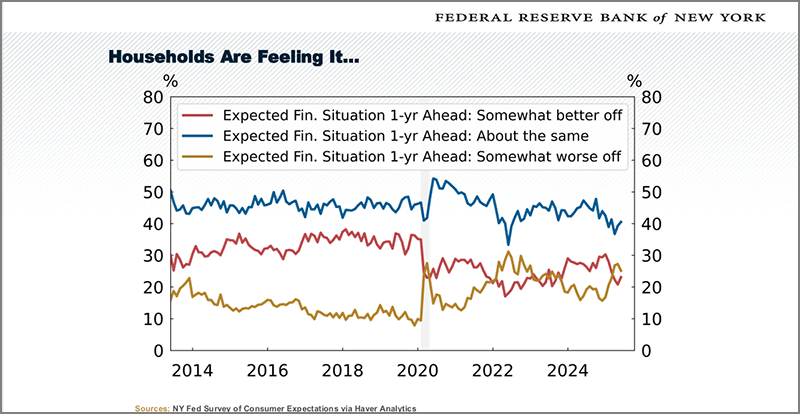

Zooming in a bit on how households view the economy (an important indicator of willingness to spend), about 40 percent of households expected their financial situation to remain the same in the next year (down from near 50 percent a few months ago), while the number of households that expected their financial situation to worsen exceeded those that expected it to improve. The last time that metric occurred was during COVID-19.

Athreya told the audience that consumers expected the unemployment situation to be higher next year, compared to a historical average measuring consumer expectations.

Consumer outlook on inflation 1-year, 3-years and 5-years ahead was in accord with historic views with expectations of continued inflation hovering around 3 percent, just over the Fed’s target inflation rate of 2 percent.

Regarding interest rates, Athreya talked about the possibility of a reduction, and how much that reduction, if it occurs, might be tempered by elevated levels of uncertainty in the markets, surrounding inflation and trade, and how those factors might influence decisions on interest rates.

In June the Federal Open Market Committee (FOMC), the group that sets monetary policy in the United States, said that uncertainty about the economic outlook has diminished, but remains elevated. It acknowledged that “the unemployment rate remains low, and that labor market conditions remain solid”, but “that inflation remain somewhat elevated.”

Athreya said the markets were attentive to the de-escalation in trade tensions, but that the rise in both short-term and long-term bond yield reflected the continued uncertainty about the future.

Turning to consumer issues, the Federal Reserve reports that homeowners’ home equity remained at an all-time high. “Stock wealth” based on recent declines in stock values, was set back to a year ago level. Debt, as a share of household disposable income, remained relatively low and stable, and the rate of unemployment remained low. Real earnings and household income boasted solid growth.

Turning specifically to Rockland County, Athreya spoke broadly about manufacturing and employment.

On the manufacturing front, he referred to the Empire State Manufacturing Survey and Business Leaders Survey, which suggested manufacturing activities have been declining in the region. Both surveys revealed declines in manufacturing and service activity.

On the employment front, he spoke about the hit Rockland took in employment during COVID (job losses around 25 percent) and the strength of Rockland’s recovery with employment now at more than 5 percent over pre-pandemic levels. Rockland County’s employment recovery exceeded both the New York City and the National indexes.

Overall, Athreya offered some optimistic conclusions: recession-free disinflation was underway (meaning that the inflation rate was declining and that the decline was not caused by a recession), Fed policymakers are expecting slowing growth, but not a recession, uncertainty is elevated, and supply shocks are a challenge to the economy and the Fed’s decision-making on monetary policy.