|

RCBJ-Audible (Listen For Free)

|

Only Four Of The Five Rockland Towns Have Agreed To Use The New Shelter; Orangetown Has Not Opted In

By Tina Traster

Howard Phillips likes to say: “the devil is in the details.” He’s right.

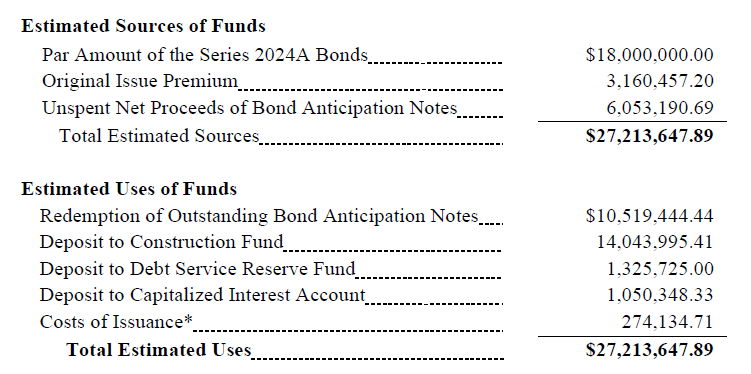

The $18 million bond Offering Statement Rockland Green presented to investors tells the story of long-term debt at a high interest rate for an ambitious animal shelter project that was floated and sold to public officials without financial projections.

When Phillips, Chairman of Rockland Green (Solid Waste Management Authority), came to the Rockland County Legislature in 2022 to include animal management in the Authority’s wheelhouse, he said a new animal shelter could be built for $8 million. He convinced several elected officials to forego a long-time plan to rebuild Hi Tor Animal Shelter in Pomona on its County-owned site and instead pursued the purchase of an empty warehouse built on-spec on Ecology Road in the Village of West Haverstraw. Nearly half of the former project’s monies had already been raised by Hi Tor, through the county’s capital budget, and state grants. Had the county moved forward with the project, it would have needed to bond only $10 million.

The projected price-tag for the animal shelter run by Rockland Green continues to rise. RCBJ has taken a closer look at the $18 million bond Offering Statement presented to investors who purchased the Solid Waste Management Authority’s “Special Obligation” bonds.

To begin, taxpayers will be on the hook to foot the bill to pay principal and interest on the bond over the next thirty years. The bond is a 30-year “Special Obligation” bond with a face value of $18 million that carries a 5.5 percent interest rate for about $9 million of the issue, and 6.25% for $9 million that matures in 2049 and 2054. The bonds are rated Aa3 (a high rating with a low credit risk).

The debt service will cost about $1.3 million annually through 2054. The total amount of interest on the bond will be $21,419,788. With the repayment of principal and interest, the total amount paid for the bond will be $39,419,788. Nearly $40 million. And that does not include the annual operation of the shelter, which will levy taxpayers $2 million in 2025 and rise steadily every year.

Also, Rockland Green is facing a lawsuit with Hi Tor Animal Shelter over a breach of contract dispute. Both sides accuse the other of breach of contract. The case, filed in May 2024, will rack up attorney’s fees on a continuing basis.

Speaking of the devil in the detail, with only $14 million set aside in the construction fund, Rockland Green has made no allowances for change orders or overages. It is unlikely that the project will come in on budget, based on Rockland Green’s project history, particularly the building of the Materials Recovery Facility (MRF), which required more than 100 change orders.

The 5.5/6.25 percent interest rate Rockland Green has agreed to pay is higher than most municipal bonds. Based on recent data, the average rate on new offers of municipal bonds is around 3.2 percent for a 10-year maturity, with longer maturities on 30-year bonds potentially reaching around 4.05 percent depending on the credit rating and issuer.

Rockland Green’s credit rating (Aa3) is very good because it has an unlimited ability to tax residents to meet its obligations to the bondholders.

Why did Rockland Green offer to pay 5.5 percent and 6.25 percent when comparable bonds pay a lower rate?

It appears to be something known as the “Original Issue Premium” which is the amount above and beyond the face value of the bonds that an investor pays to secure the higher interest rate. By offering a higher rate, Rockland Green can sell $18 million in bonds for over $21.6 million, enabling it to raise more than the bond’s face value.

The downside is that residents will be saddled with paying substantially more interest over the life of the bond than if Rockland Green offered its bonds at a lower interest rate. Additionally, the bond’s interest and principal must be paid through monies raised through the tax levy (and from funds generated by the operation of the shelter if its revenue ever exceeds the cost of running the shelter).

No funds from any other Rockland Green program can reduce the tax obligations to residents, who will be saddled for three decades.

The quasi-public authority has pledged or guaranteed payments through the collection of a tax levy on every property in four of the five towns (Stony Point, Clarkstown, Haverstraw and Ramapo). The decision to bind their constituents for 30 years rests with the four town supervisors and town boards; residents do not have a direct say in this process.

Orangetown has remained independent of the future shelter project, utilizing the Hudson Valley Humane Society for stray, abandoned, and surrendered dogs.

“We have not executed any agreement with Rockland Green as it pertains to shelter services,” said Orangetown Supervisor Teresa Kenny. “We have a contract with the Hudson Valley Humane Society, which is renewed each year. We are contracting with them again for 2025. We have been very happy with the services from the HVHS and do not see any reason for us to go elsewhere but, with that said, if circumstances were to change, the town would have the ability to enter a contract with Rockland Green for those services.”

Ongoing Costs To Run The Shelter

Town Supervisors and town boards will have to think long and hard about signing off on this project because it will lock in their communities for 30 years. Rockland Green last month approved an $18 million bond issue to reimburse itself for the costs of the empty built-on-spec warehouse it purchased in Jan. 2024, pay off outstanding bond anticipation notes, and a $14.7 million construction contract to convert the window-less warehouse into an animal shelter in a remote section of the Village of West Haverstraw.

The former Solid Waste Management Authority has awarded O’Connor Company, a Pinehurst, North Carolina firm, a contract to build out the 15,000 square-foot warehouse shell into a bilevel 28,000 square foot animal shelter at 427 Beach Road after disqualifying or rejected other bids.

According to the Offering Statement, Rockland Green estimates the cost to run the shelter (and the amount that residents will be taxed above and beyond the debt service) in 2025 is $2,067,000. That amount is up about 47 percent from 2023 budget. For 2026, Rockland Green estimates an additional 21 percent increase to $2.5 million in operating costs (though no detail is provided as to how many employees it will take to run the new shelter, or what any of the costs such as utilities, insurance, food, medicine, veterinary care, etc. will be going forward). After 2026, Rockland Green estimates the costs of running the shelter will increase 5 percent per year, year over year, and that residents will be taxed that amount in addition to debt service on the repayment of the bond. However, it’s impossible to truly project rising costs of running an animal shelter, given the volatility of energy, markets, and employment.

Rockland Green borrowed about $10 million earlier this year through Bond Anticipation Notes (BANs) – a short-term debt instrument used to finance a project until a longer-term debt replaces it. $3.8 million of the BAN was used to reimburse Rockland Green for the acquisition of the warehouse property. Rockland Green is obligated to pay off the $10 million BAN (plus interest) from the money raised in the new bond issue.

From the $21.6 million raised, only about $14 million is available for the construction of the new shelter. The rest goes to pay off the BANs, for debt service, and the cost of issuing the bonds.

Direct Benefit To Haverstraw

Finally, the Offering Statement reveals an additional benefit for the Town of Haverstraw, where the Chairman of Rockland Green also serves as the Town Supervisor. The document calls for Rockland Green to enter into a “Host Community Agreement” with the Town of Haverstraw to compensate the town for increased traffic due to the use of the animal shelter by residents countywide, access to an adjacent landfill for exercising dogs, and the provision of town services to the Animal Shelter. The amount Haverstraw will collect under the Host Agreement is not specified.

Several detractors of the project objected to the location of the proposed shelter because of its location. Their objections included its proximity to two landfills, the Joint Sewer Commission, the location’s FEMA flood designation, as well as a lack of proximate land for walking dogs. The location has also been criticized because it would be sited directly adjacent to a proposed 454,000 square-foot, 24/7 trucking warehouse that is making its way through the planning process in the Village of West Haverstraw.