|

RCBJ-Audible (Listen For Free)

|

The Many Reasons Phillips Cites In Opposition To Affordable Housing PILOTs Are Based On Inaccuracies, Disinformation, and Vagaries

By Tina Traster

On Nov. 7, MPact Collective LLC, the developer planning to resurrect the Village of Haverstraw’s fallow Chair Factory site, will be on hand to discuss its mixed-income housing proposal at its Haverstraw Forward monthly meeting at Village Hall at 7 pm. For months the Huntington, LI-based developer, that has partnered with PennRose, a Brooklyn-based affordable housing developer, has been drumming up support for much-needed affordable housing. The development will be a catalyst for economic activity in the village.

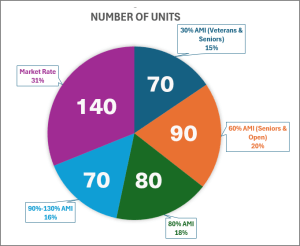

By all accounts, there is widespread support for the $340 million, 450-unit housing project on the former Chair Factory site on the 9-acre peninsula jutting into the Hudson River. (70 percent of units will be affordable including set asides for veterans, seniors and those below income thresholds). Mayor Michael Kohut and village officials have championed the project from the start, when they selected MPact, which was one of four developers that bid for the project. County officials including County Executive Ed Day and those fighting for affordable housing, as well as Rockland’s Industrial Development Agency, have also lined up behind the project. And so has the school district.

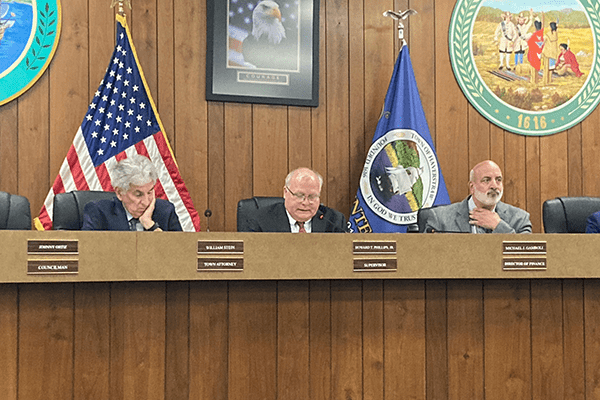

The only outlier is Town of Haverstraw Supervisor Howard Phillips, who has let his opposition to the project be known at Town Hall meetings, in the town’s bi-annual fall newsletter sent last week, at the Haverstraw Collective on Oct. 2, and in public at large. Phillips’ opposition to the issue is only relevant to the plan’s momentum because the developer is seeking a PILOT (payment in lieu of taxes), which has been approved by the Rockland IDA, and has support from the county, village, and the school district.

Phillips is opposed to the town’s participation in the PILOT.

In repeated statements spelling out his opposition, Phillips tends to either mislead or bend the truth over several matters. He says, “the devil is in the details,” but he never offers details. He rails about the threat of certiorari challenges from other landlords but experts say that’s mixing apples and oranges; he says the developer failed to include a swimming pool (which it has); he maintains the project will not bring an economic boost to Haverstraw because residents’ incomes will be too low but experts have shown there will be an economic benefit; and he complains the project isn’t fair because a portion of the lottery for units will be open to Hudson Valley residents at large. He also falsely states there was only one developer who showed an interest in the property — there were four. And he claims there will be a set-aside for the mentally ill and recovering drug and alcohol addicts, but the only set-aside at the Chair Factory is for Veteran’s housing.

During an Oct. 22 Town Hall meeting, residents speaking in favor of the project were given no encouragement.

Mari Morrison Rodriquez told Phillips and the town board her family had lived in North Rockland since the Revolutionary War. She said her family, children and grandchildren are still here, many in Haverstraw, adding “and I know many of them who are struggling.” She added, “people are ready to retire but their kids are still home because they can’t find anything affordable, and they are in the Rockland County workforce already making decent pay. Or they are families just starting out, or they’re on fixed incomes as seniors.”

Rodriquez was making the case Rockland County needs affordable housing, and the Chair Factory is a one-time opportunity that should not be forsaken.

“I came here today to advocate for the Chair Factory project in the Village,” she said in an emotional plea. “I’m not understanding why the Chair Factory, who is investing in our community with attainable, integrated workforce housing, is being excluded from the opportunity. It’s even providing low-income Veterans’ housing.”

While most of the speakers addressed concern over the undermining of the Chair Factory plan, at least two other developments have been impacted by Phillips’ opposition to additional affordable housing in the villages or the town at large. Earlier this year, he orchestrated a plan through some questionable tactics to convince the Knights of Columbus to donate their building at 56 West Broad, rather than see through a sale to an affordable housing developer, St. Katherine Group of Port Chester, for $2.4 million. In emails and texts examined by RCBJ, Phillips scares the Knights into believing the archdiocese is going to take the lion’s share of the proceeds of the sale. The developer had promised more than 100 affordable units.

In a private text message exchange with the Knights of Columbus’ Grand Knight Joe Vargas in August, Phillips referred to the housing proposals in the village as “ridiculous,” and said, “I’m getting to the point and so are other Board Members where we’re going to go public on some of the ridiculous housing that the Village is proposing.”

Also on the hook is the Westchester-based Westhab Inc., which is planning 81 affordable housing units at 63 Maple Avenue in the village. The developer is awaiting a PILOT.

Without a PILOT agreement, neither project can secure necessary government financing and tax credits that enable affordable developments to be built. MPact Collective has said it will not purchase the property until the PILOT is approved, and other state and private funding is in place. The developer plans to pay nearly $8 million for the nine-acre site, as well as three to four private parcels it is in the process of acquiring.

While Phillips tells town residents he will “continue to look at any and all proposals” in the town’s newsletter, and “keep residents informed on the progress,” he has done nothing but list reasons, often unsubstantiated, to oppose the Chair Factory.

To begin, he raises objection to the fact that developers who accept state and federal funding for affordable housing are required to open occupancy to residents of other Hudson Valley counties. New York State requires affordable developments that accept state funding to open occupancy beyond the immediate community. Those in favor of the project, including first responders, health care workers, service sectors employees, teachers, office workers and tradesman, cannot find affordable housing. Creating affordable housing is a stimulus for attracting people with moderate incomes who shop, pay taxes, and vote. That they may come from other parts of the Hudson Valley means new faces and fresh ideas for the community.

In contrast to withholding PILOT approval for the Chair Factory project, the Town of Haverstraw this year swiftly signed off on two market-rate developments with PILOTs: BNE’s 300-plus unit luxury development in Letchworth Village and another development for 228 units at the site of the former Oak Tree Bungalow colony. Both developments are in the town’s LA-17 (Luxury Housing) zone and neither will provide affordable units or public amenities. Both are for-profit projects, and do not have lotteries. These rentals are open to the entire marketplace, including people from outside the county.

Phillips criticizes the project’s alleged set-aside of units for people who are recovering from alcohol, drugs, homelessness and mental illness. However, the Chair Factory developer is planning on providing veterans and others receiving supporting services earning 30 percent of the Area Median Income (AMI) with one-bedroom apartments for $796/month, but there is no set-aside for those recovering or dealing with addiction or mental illness. It’s not clear why Phillips opposes this kind of supportive housing for veterans and seniors – he just does.

An argument Phillips repeatedly cites is that the PILOT agreement would “open up the Town to potential lawsuits from other apartment complexes that want their taxes reduced.” Three experts and legal practitioners RCBJ interviewed have rejected the notion that an owner of an apartment complex can utilize a development under a PILOT as the basis for a tax reduction.

There are several reasons why Phillips’ representation is unsupported.

First, commercial properties are not based on “comparables” — income producing properties are valued using a direct capitalization approach, which means multiplying the net income earned from the property by a capitalization rate to determine a fair market value. Capitalization rates are economic multipliers determined by several factors, including interest rates, features of similar properties, economic risks and demographic trends.

Properties with PILOT agreements are not assessed by the Town Assessor. The valuation is negotiated based on the economic benefits, jobs, and the level of improvements and amenities the developer invests to undertake the project. The PILOT agreement is exchanged for the investment the developer makes in the community that other properties have not provided.

One local expert who preferred anonymity told RCBJ, “IDA incentives (including a PILOT) are authorized and ultimately implemented by the IDA, after the IDA board deems a project eligible and warranting incentives. Each project and the reason to give incentives is unique. A PILOT essentially encourages economic development or other needs of the community. It’s hardly an “apple to apple” comparison to another property for purposes of a tax certiorari. I don’t see the direct correlation of tax certiorari to PILOT payments.”

A Westchester-based attorney practicing tax certiorari law told RCBJ, “A court in a tax certiorari does not normally look to the assessed value of one property as evidence of what the assessed value of a neighboring property should be. That should hold for values expressed in a PILOT agreement as well.”

In January, the Rockland IDA authorized a raft of benefits for the $340 million project, including $1.65 million exemption from mortgage tax recording, an $18.5 million exemption from sales tax, and the approval to participate in a PILOT program. The Westchester-based Westhab Inc., which is planning 81 affordable housing units at 63 Maple Avenue in the village, is also awaiting a PILOT approval from Phillips.

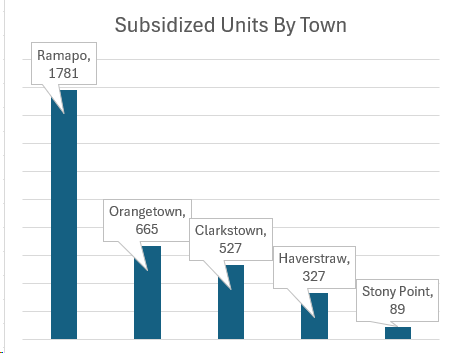

Phillips likes to tout how Haverstraw has done more for affordable housing than other towns and cities, pointing to his decades old effort to implement rent stabilization and his expansion of trailer parks. He denigrates the 2024 Rockland County Housing Needs Assessment prepared by Pattern For Progress, a think tank, which pegged the Town of Haverstraw as placing fourth out of the five towns for subsidized housing units. He believes trailer park units should have been included in Haverstraw’s tally – though they are not subsidized.

According to the report, Haverstraw has 327 subsidized units, landing second to last among the five towns. Ramapo leads with 1,781, followed by 665 in Orangetown, and 527 in Clarkstown. Stony Point has the fewest, 89.

The report says 42 percent of the town’s (Town of Haverstraw) residents are housing burdened, while 52 percent of residents in the Village of Haverstraw are spending more than 30 percent of income on housing costs.

Phillips repeatedly misstates the facts by saying there was only one bidder and one proposal to develop the Chair Factory. Proposals were submitted by four separate teams — Calyx, M Squared, MPact Collective, and the O’Neill group – from which the Village selected MPact Collective. He also tells constituents that the village only accepted the proposal to pay off a $9 million judgment related to the acquisition of the property but village officials view a restored waterfront as a catalyst for an economic renaissance.

Phillips also raises concerns about traffic and the demand on town services, even though those issues have been addressed satisfactorily during the SEQRA (State Environmental Quality Review Act) review. Phillips denigrates experts who conducted the studies and disregards their validity, claiming to know better but does not provide facts.

Finally, and most misleadingly, Phillips says, “the rest of the residents will be subsidizing all the services for school, county, town and village property taxes.” This fallacy is a scare tactic to drum up opposition to affordable housing options under the guise that residents in these units will “not pay their fair share.” The argument falls apart when one considers that there is no “fair share” when it comes to taxes. Seniors and empty nesters, for example, continue to subsidize school taxes. Homeowners cover the costs of hospitals, churches, and properties owned by charities and religious institutions. Tax exemptions and benefits are provided for seniors and others based on income limitations. Breaks are also provided to homesteaders, veterans, first responders, and for the disabled and blind, and through STAR relief. Relief is available for green buildings, for clergy, and countless others.

According to the Empire Center, the North Rockland Central School District will spend $35,570 per pupil this year, substantially more than an individual resident pays in school taxes, but families with school-age children, and families with multiple students in school, are not singled out as being “subsidized.”

“Workforce housing is essential to retain the youth, seniors, and to build a strong middle class that will remain in North Rockland,” said Village resident Magda Truchan, during the town hall meeting. “It’s time to take into account our demographic realities. A healthy county is one that listens to all people and creates equitable solutions.”

A public hearing on the Site Plan and Subdivision Application will be held on November 18, 2024, at 7:05 pm at the Village Hall.