|

RCBJ-Audible (Listen For Free)

|

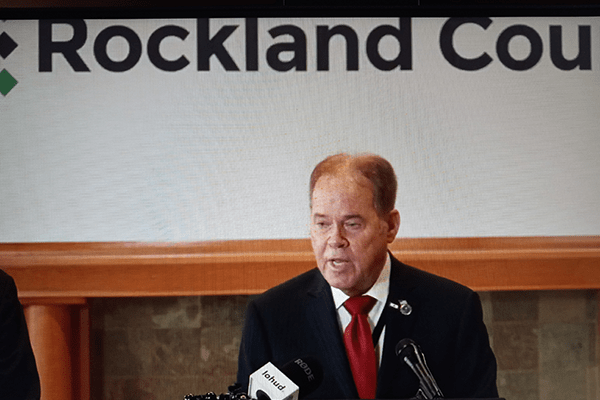

Day Extols County For Financial Diligence; Cites Healthy Bond Credit Ratings

Rockland County Executive Ed Day is proposing a 2 percent county property tax cut for 2025’s $876 million budget. This is the second consecutive year the County’s office has fashioned a 2 percent tax cut, coming on the heels of zero tax increases in 2022 and 2023.

“I am so proud that our finances are the best they have ever been in Rockland’s history,” said Day, while introducing the proposed 2025 county budget Tuesday at the Robert Yeager Health Center in Pomona.

“We continue to be one of the fiscally strongest counties in New York and our bond credit ratings are tied for the top tier, an achievement only six other counties share.”

Day credited the county’s fiscal success to the implementation of conservative budgeting and prudent financial management since he took the helm in 2014.

“You never can predict an unprecedented crisis,” he said.

Day pointed out that despite the challenges of the COVID pandemic, which brought the county to a near halt, inflation, and on-and-off high gas prices, the county has thrived by imposing austerity budgets and freezing hires when necessary.

“This budget serves as a roadmap toward a brighter future, one that puts our residents’ well-being at the forefront, fosters economic growth, and promotes environmental sustainability,” said Day. “I again ask my partners in government and our esteemed Legislature to remember all it takes is one catastrophic event to wipe out our fiscal success.”

The American Rescue Plan funding served as a stopgap. Day said the county gave over $2 million to small businesses and restaurants to help them rebound from the pandemic. Nearly $10 million was allocated to parks and open space programs.

“We have acquired 308 acres of open space for $11 million,” said Day. “Only $4 million came out of county funds.”

Day said municipalities that used ARPA funding to obscure budget shortfalls went on a “fool’s errand” because the monies are not a forever fund.

The county used $13. 5 million in ARPA funds to supplement program costs for the Housing Action Loan Opportunity (HALO) program. “This new program will provide direct loans to borrowers to create workforce housing,” said Day. “As loan repayments flow back into the county, this money will continue to create housing opportunities indefinitely.”

Rockland County is suffering from a severe affordable housing crisis. A 2023 Hudson Valley Pattern for Progress’s 2023 report underscores the affordability crisis for housing in the region, as stagnant wages, increasing rents, and skyrocketing home prices have stretched household budgets to their limits.

The proposed county budget continues to fund the HERROS college tuition program for volunteer fire fighters and emergency medical services. This program reimburses volunteers up to $6,000 in college tuition.

More than 100 volunteers have been reimbursed over $200,000 under our HERROS program.

The Department of Mental Health is launching the Rockland County Behavioral Health Training Institute in 2025. This program will provide education on behavioral health disorders, treatment, and more to the community and to providers. The Department is also creating the New York State Office for People with Disabilities or “OPWDD Navigator” program, aimed at helping families navigate the necessary testing and paperwork to secure benefits for their loved ones with special needs.

“Every year when my administration creates the budget, the number one overriding question we constantly ask ourselves is how to deliver the most efficient services at the lowest cost to you, the taxpayer,” said Day. “For this reason, we are prioritizing investments in recruitment because we know we are only as strong as our team.”

The Department of Personnel is expanding residency requirements, meaning more hires will need to live in the county. The Department is continuing its Emerging Leader program, which enables employees to develop leadership skills that open the door for promotion.

The budget proposes a 10 percent increase in funding for nonprofit contract agencies, “as we remain committed to standing by the organizations on the ground helping residents enduring hard times and challenges,” Day said.

Day reminded the audience that an unexpected financial hit is always possible – though the long-brewing battle over taxes paid by both the Palisades Center and the Shops at Nanuet were not entirely a surprise.

In July, the Palisades Center walked away with half of what it was asking for in a protracted tax challenge that ended with a settlement. The Shops At Nanuet also cut a deal with Clarkstown and the Nanuet School District. The settlements cap many years of tax challenges filed in Rockland County Supreme Court by both the Palisades Center and the Shops At Nanuet.

The Town of Clarkstown has agreed to refund the owners of the Palisades Center $27.5 million in property taxes paid to the town, the Clarkstown school district and Rockland County over a four year period. The town also agreed to a yet-to-be disclosed multi-million-dollar tax settlement with the Shops of Nanuet owner The Retail Property Trust.

“We need to be cautious, direct spending at only what is needed and necessary, and continue to stand ready for the unexpected like the recent Clarkstown Tax settlement that cost the county about $11 million.”

Day also touted his administration’s accomplishments on going green.

“By using 100 percent wind power, we save over $500,000,” he said, adding that the county has snagged a $75,000 Climate Smart Community state grant to create a Climate Action Plan.

The county is also beefing up law enforcement, creating a crypto-currency unit.

And Day expressed pride over “investing in youth,” by expanding the Youth Employment Program, which has helped 200 participants. He added the county is using a $2.7 million state grant “which is no cost to the taxpayer.”

Finally, Day gave a shout-out to the ongoing local filming program, which has brought in nearly $225,000 since its inception.

Day closed on a proud and upbeat note about the county’s hale bond ratings.

“With upcoming Capital Projects or Improvements, thanks to our strong A bond ratings across the board, we will choose between bonding at a low interest rate or using our healthy fund balance to avoid paying interest — whichever is better for residents.”

Fitch Ratings in May upgraded Rockland County’s General Obligation Bond Rating from “AA-” to “AA+. The upgraded ratings mean that when the county borrows money to fund capital projects, it can do so at a lower cost; saving taxpayer dollars.

This rating increase follows the county completing payments of the $96 million deficit bond back in March. The rating report gave Rockland a positive outlook writing, the grade is supported by its “high midrange budgetary flexibility and a continued trend of structurally balanced operations.”

The report cited “new management and new financial policies had contributed to the county’s improved financial position” since 2013.

Imploring the county legislature to sign off on the proposed budget, Day said, “This is not just about the numbers; its about families and local businesses.”